Question: Problem 3. (10 Points) Consider a European put option with strike price X $50 and expiry in 5 months. The current stock price is S(0)

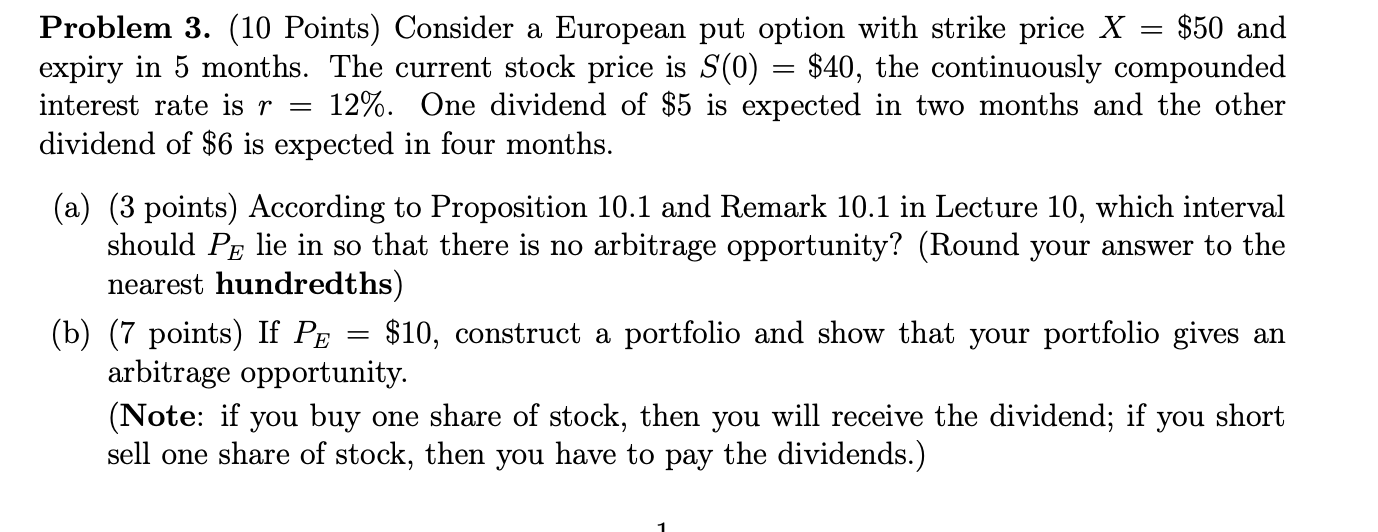

Problem 3. (10 Points) Consider a European put option with strike price X $50 and expiry in 5 months. The current stock price is S(0) = $40, the continuously compounded interest rate is r = 12%. One dividend of $5 is expected in two months and the other dividend of $6 is expected in four months. (a) (3 points) According to Proposition 10.1 and Remark 10.1 in Lecture 10, which interval should Pe lie in so that there is no arbitrage opportunity? (Round your answer to the nearest hundredths) (b) (7 points) If Pe $10, construct a portfolio and show that your portfolio gives an arbitrage opportunity. (Note: if you buy one share of stock, then you will receive the dividend; if you short sell one share of stock, then you have to pay the dividends.) Problem 3. (10 Points) Consider a European put option with strike price X $50 and expiry in 5 months. The current stock price is S(0) = $40, the continuously compounded interest rate is r = 12%. One dividend of $5 is expected in two months and the other dividend of $6 is expected in four months. (a) (3 points) According to Proposition 10.1 and Remark 10.1 in Lecture 10, which interval should Pe lie in so that there is no arbitrage opportunity? (Round your answer to the nearest hundredths) (b) (7 points) If Pe $10, construct a portfolio and show that your portfolio gives an arbitrage opportunity. (Note: if you buy one share of stock, then you will receive the dividend; if you short sell one share of stock, then you have to pay the dividends.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts