Question: Problem 3 (10 points) Consider a put option with $50 strike price and maturity equal to 1 year. The underlying stock price is $40 and

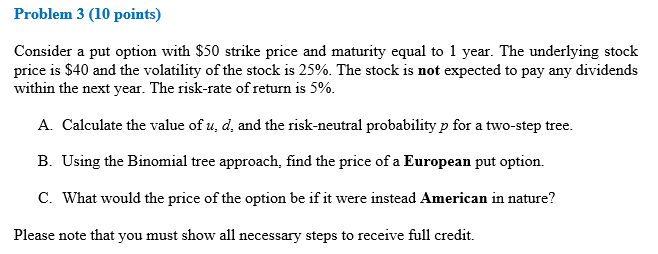

Problem 3 (10 points) Consider a put option with $50 strike price and maturity equal to 1 year. The underlying stock price is $40 and the volatility of the stock is 25%. The stock is not expected to pay any dividends within the next year. The risk-rate of return is 5%. A. Calculate the value of u, d, and the risk-neutral probability p for a two-step tree. B. Using the Binomial tree approach, find the price of a European put option. C. What would the price of the option be if it were instead American in nature? Please note that you must show all necessary steps to receive full credit. Problem 3 (10 points) Consider a put option with $50 strike price and maturity equal to 1 year. The underlying stock price is $40 and the volatility of the stock is 25%. The stock is not expected to pay any dividends within the next year. The risk-rate of return is 5%. A. Calculate the value of u, d, and the risk-neutral probability p for a two-step tree. B. Using the Binomial tree approach, find the price of a European put option. C. What would the price of the option be if it were instead American in nature? Please note that you must show all necessary steps to receive full credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts