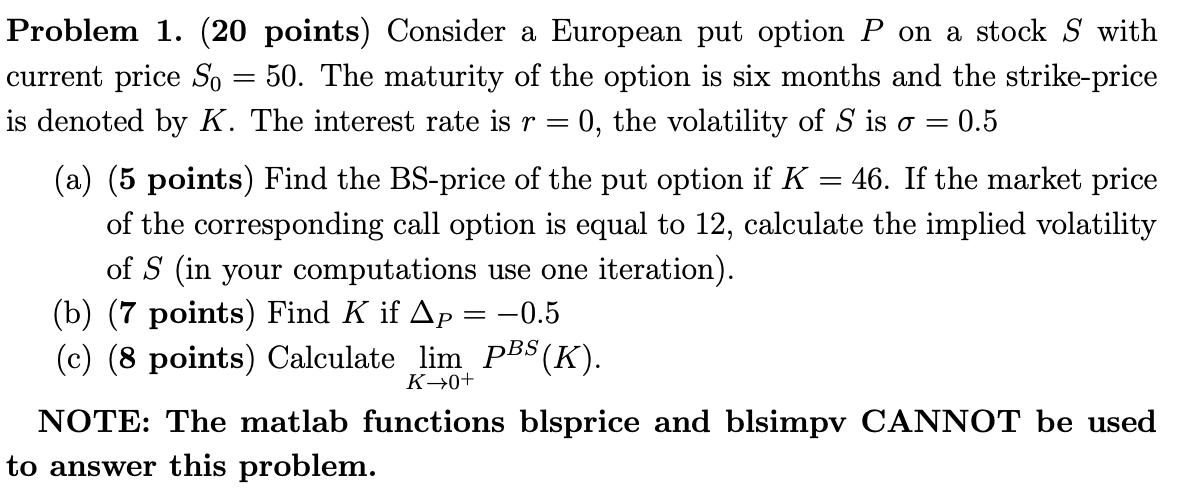

Question: = Problem 1. (20 points) Consider a European put option P on a stock S with current price So = 50. The maturity of the

= Problem 1. (20 points) Consider a European put option P on a stock S with current price So = 50. The maturity of the option is six months and the strike-price is denoted by K. The interest rate is r = 0, the volatility of S is o = 0.5 (a) (5 points) Find the BS-price of the put option if K 46. If the market price of the corresponding call option is equal to 12, calculate the implied volatility of S (in your computations use one iteration). (b) (7 points) Find K if Ap = -0.5 (c) (8 points) Calculate lim PBS(K). NOTE: The matlab functions blsprice and blsimpv CANNOT be used to answer this problem. = K +0+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts