Question: Problem 3 ( 3 pts ) : You are the chief investment officer for Nova - LP Funds, a top inter - galactic investment firm

Problem pts: You are the chief investment officer for NovaLP Funds, a top inter

galactic investment firm in the Milky Way Galaxy. With the increasing economic activity

across different star systems, you have identified three primary investment opportunities:

Neptunian Real Estate, Martian Tech Startups, and Andromedan Space Mines.

Each investment option has its expected return rate, risk, and minimum investment

amount. Your challenge is to decide how much to invest in each opportunity to maximize

your potential returns, while staying within your allocated investment budget and meeting

any minimum investment thresholds.

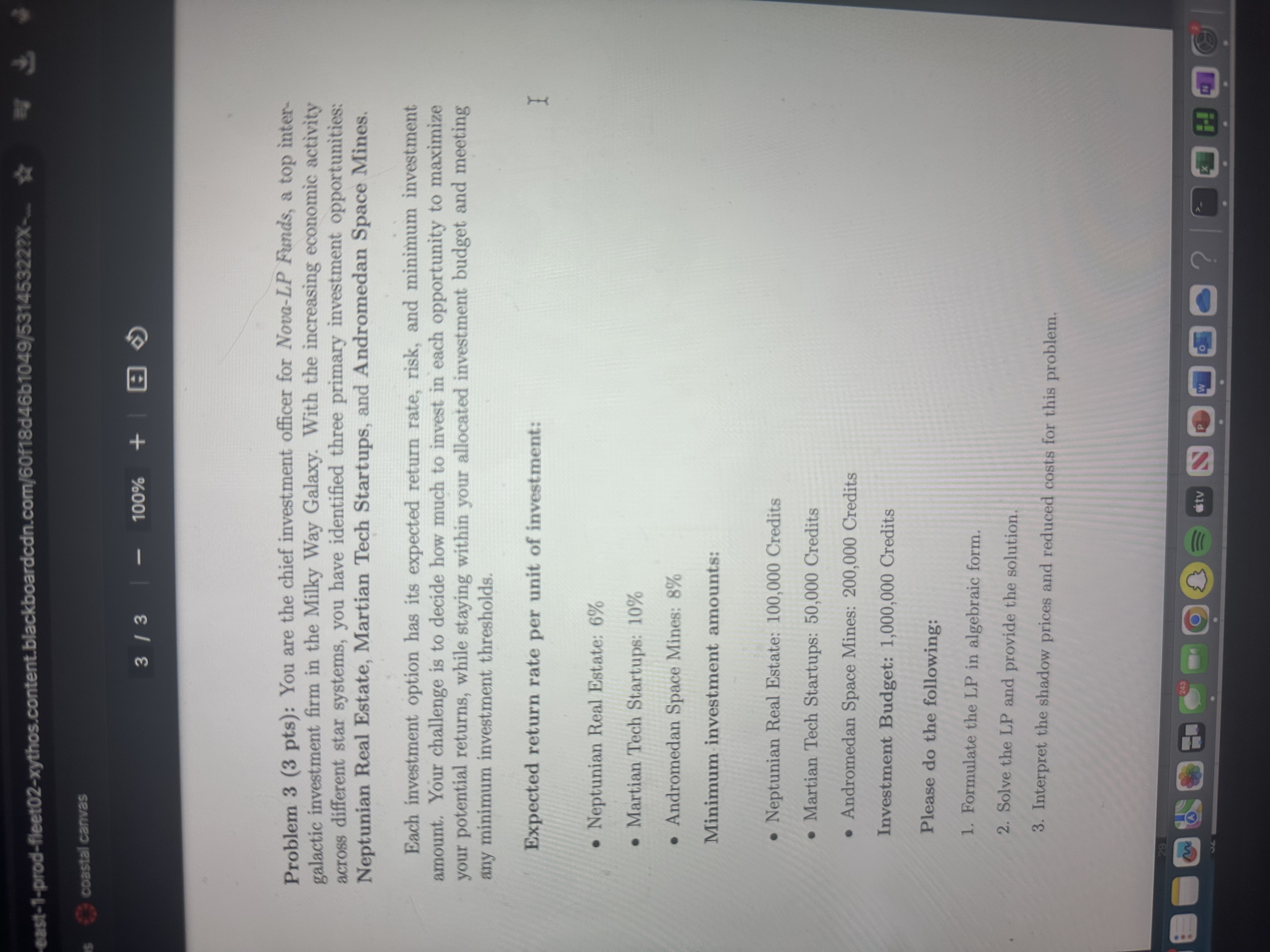

Expected return rate per unit of investment:

Neptunian Real Estate:

Martian Tech Startups:

Andromedan Space Mines:

Minimum investment amounts:

Neptunian Real Estate: Credits

Martian Tech Startups: Credits

Andromedan Space Mines: Credits

Investment Budget: Credits

Please do the following:

Formulate the LP in algebraic form.

Solve the LP and provide the solution.

Interpret the shadow prices and reduced costs for this problem.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock