Question: Problem 3 ( 4 0 p ) ( Delta Hedging ) Assume we are in a Black - Scholes world where on day t =

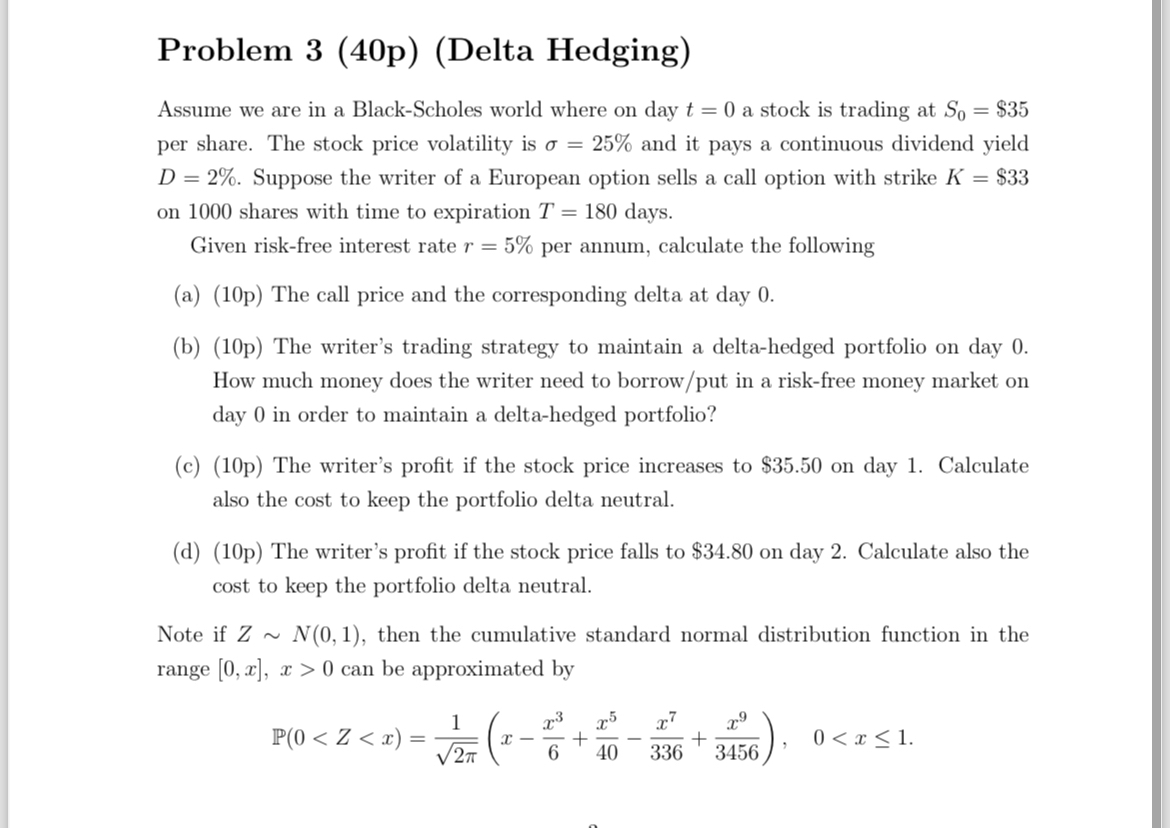

Problem pDelta Hedging

Assume we are in a BlackScholes world where on day a stock is trading at $ per share. The stock price volatility is and it pays a continuous dividend yield Suppose the writer of a European option sells a call option with strike $ on shares with time to expiration days.

Given riskfree interest rate per annum, calculate the following

ap The call price and the corresponding delta at day

b The writer's trading strategy to maintain a deltahedged portfolio on day How much money does the writer need to borrowput in a riskfree money market on day in order to maintain a deltahedged portfolio?

cp The writer's profit if the stock price increases to $ on day Calculate also the cost to keep the portfolio delta neutral.

dp The writer's profit if the stock price falls to $ on day Calculate also the cost to keep the portfolio delta neutral.

Note if then the cumulative standard normal distribution function in the range can be approximated by

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock