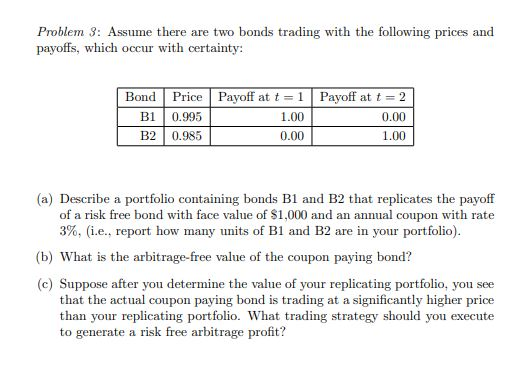

Question: Problem 3: Assume there are two bonds trading with the following prices and payoffs, which occur with certainty: Payoff at t=1 Payoff at t =

Problem 3: Assume there are two bonds trading with the following prices and payoffs, which occur with certainty: Payoff at t=1 Payoff at t = 2 Bond | Price B1 0.995 B2 0.985 0.00 1.00 (a) Describe a portfolio containing bonds B1 and B2 that replicates the payoff of a risk free bond with face value of $1,000 and an annual coupon with rate 3%, i.e., report how many units of B1 and B2 are in your portfolio). (b) What is the arbitrage-free value of the coupon paying bond? (c) Suppose after you determine the value of your replicating portfolio, you see that the actual coupon paying bond is trading at a significantly higher price than your replicating portfolio. What trading strategy should you execute to generate a risk free arbitrage profit? Problem 4: Assume the price of a zero coupon U.S. Treasury bond that pays $1,000 in one year is trading at $975.61. Assume an identical bond (pays $1,000 in one year) issued by firm XYZ is trading at $938.97. What is the credit risk premium that investors require in order to hold firm XYZ debt (bonds)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts