Question: Problem 3: Boutique Local Brewery You are considering opening a brewery, because if there is one thing Springs needs more of, it's another craft brewery.

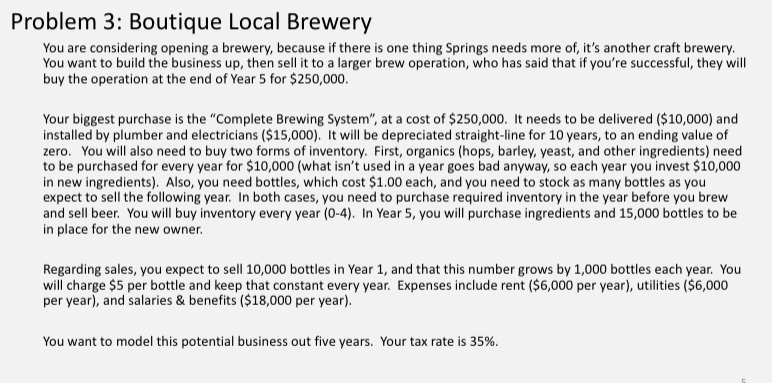

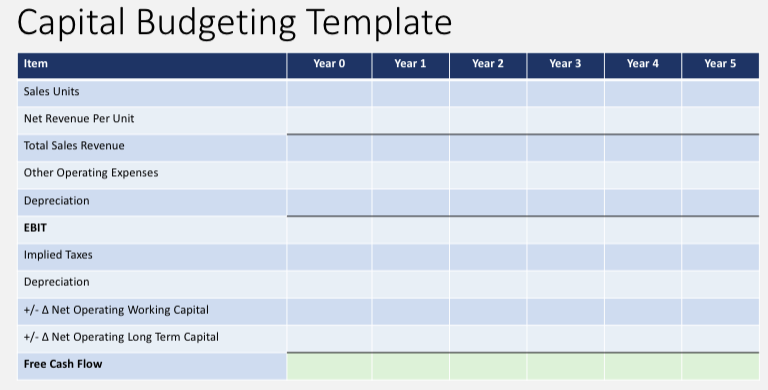

Problem 3: Boutique Local Brewery You are considering opening a brewery, because if there is one thing Springs needs more of, it's another craft brewery. You want to build the business up, then sell it to a larger brew operation, who has said that if you're successful, they will buy the operation at the end of Year 5 for $250,000. Your biggest purchase is the "Complete Brewing System", at a cost of $250,000. It needs to be delivered ($10,000) and installed by plumber and electricians ($15,000). It will be depreciated straight-line for 10 years, to an ending value of zero. You will also need to buy two forms of inventory. First, organics (hops, barley, yeast, and other ingredients) need to be purchased for every year for $10,000 (what isn't used in a year goes bad anyway, so each year you invest $10,000 in new ingredients). Also, you need bottles, which cost $1.00 each, and you need to stock as many bottles as you expect to sell the following year. In both cases, you need to purchase required inventory in the year before you brew and sell beer. You will buy inventory every year (0-4) In Year 5, you will purchase ingredients and 15,000 bottles to be in place for the new owner. Regarding sales, you expect to sell 10,000 bottles in Year 1, and that this number grows by 1,000 bottles each year. You will charge $5 per bottle and keep that constant every year. Expenses include rent ($6,000 per year), utilities ($6,000 per year), and salaries &benefits ($18,000 per year) You want to model this potential business out five years. Your tax rate is 35%. Capital Budgeting Template Year 1 Item Sales Units Net Revenue Per Unit Total Sales Revenue Other Operating Expenses Depreciation EBIT mplied Taxes Depreciation +/-a Net Operating Working Capital +/-a Net Operating Long Term Capital Free Cash Flow Year 0 Year 2 Year 3 Year 4 Year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts