Question: Problem 3. Modigliani-Miller with taxes: U & L U and L are two firms similar in all kinds except their capital structure. U is a

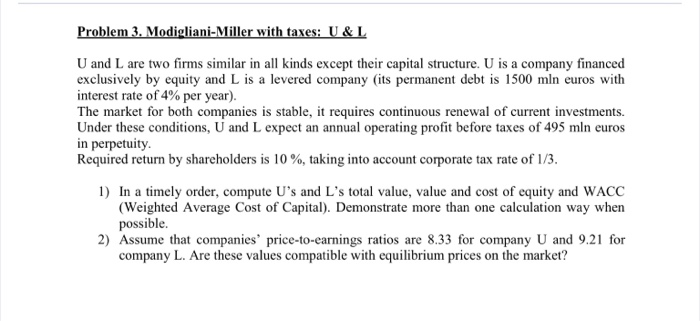

Problem 3. Modigliani-Miller with taxes: U & L U and L are two firms similar in all kinds except their capital structure. U is a company financed exclusively by equity and L is a levered company (its permanent debt is 1500 mln euros with interest rate of4% per year). The market for both companies is stable, it requires continuous renewal of current investments. Under these conditions, U and L expect an annual operating profit before taxes of 495 mln euros in perpetuity. Required return by shareholders is 10 %, taking into account corporate tax rate of 13. 1) In a timely order, compute U's and L's total value, value and cost of equity and WACC (Weighted Average Cost of Capital). Demonstrate more than one calculation way when possible. 2) Assume that companies' price-to-earnings ratios are 8.33 for company U and 9.21 for company L. Are these values compatible with equilibrium prices on the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts