Question: Problem 3. Pensions Valiant Co. has a noncontributory, defined benefit pension plan. For 2020, the company determines the following information: ($ in millions) PBO balance,

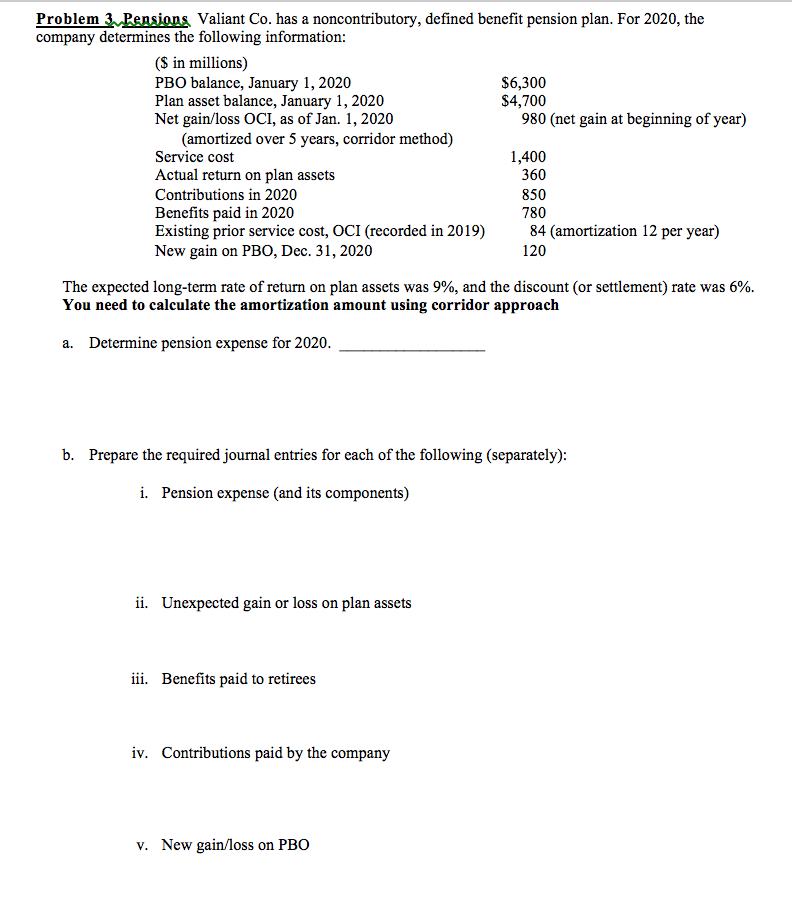

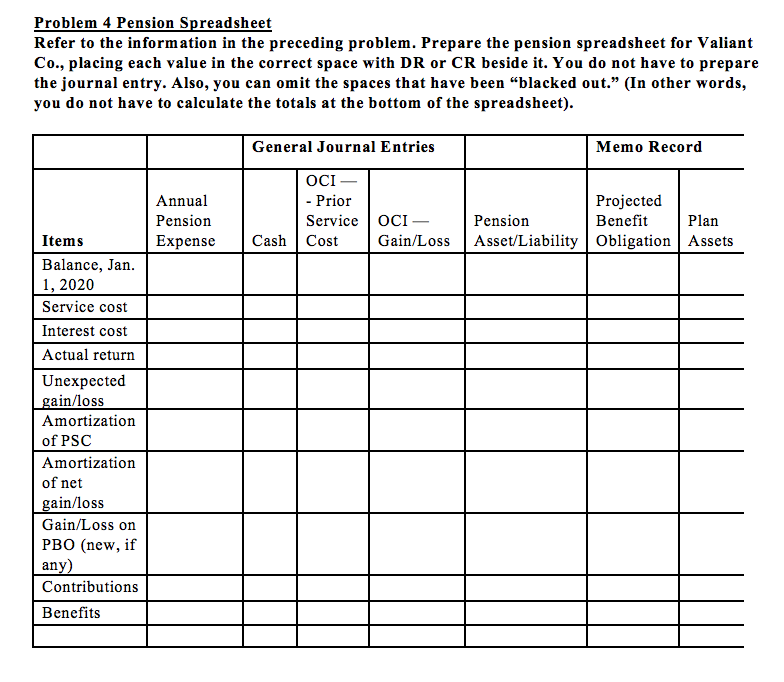

Problem 3. Pensions Valiant Co. has a noncontributory, defined benefit pension plan. For 2020, the company determines the following information: ($ in millions) PBO balance, January 1, 2020 $6,300 Plan asset balance, January 1, 2020 $4,700 Net gain/loss OCI, as of Jan. 1, 2020 980 (net gain at beginning of year) (amortized over 5 years, corridor method) Service cost 1,400 Actual return on plan assets 360 Contributions in 2020 850 Benefits paid in 2020 780 Existing prior service cost, OCI (recorded in 2019) 84 (amortization 12 per year) New gain on PBO, Dec. 31, 2020 120 The expected long-term rate of return on plan assets was 9%, and the discount (or settlement) rate was 6%. You need to calculate the amortization amount using corridor approach a. Determine pension expense for 2020. b. Prepare the required journal entries for each of the following (separately): i. Pension expense (and its components) ii. Unexpected gain or loss on plan assets iii. Benefits paid to retirees iv. Contributions paid by the company v. New gain/loss on PBO Problem 4 Pension Spreadsheet Refer to the information in the preceding problem. Prepare the pension spreadsheet for Valiant Co., placing each value in the correct space with DR or CR beside it. You do not have to prepare the journal entry. Also, you can omit the spaces that have been "blacked out." (In other words, you do not have to calculate the totals at the bottom of the spreadsheet). General Journal Entries Memo Record Annual Pension Expense OCI - - Prior Projected Service | oc Pension Benefit Cost Gain/Loss | Asset/Liability | Obligation Assets fit Plan Cash Items Balance, Jan. 1, 2020 Service cost Interest cost Actual return Unexpected gain/loss Amortization of PSC Amortization of net gain/loss Gain/Loss on PBO (new, if any) Contributions Benefits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts