Question: Problem 3 See pages 176-177 and Practice Problem 2 with Solution, Page 183) Medical Equipment of Tampa Inc. trying to develop an asset-financing plan. The

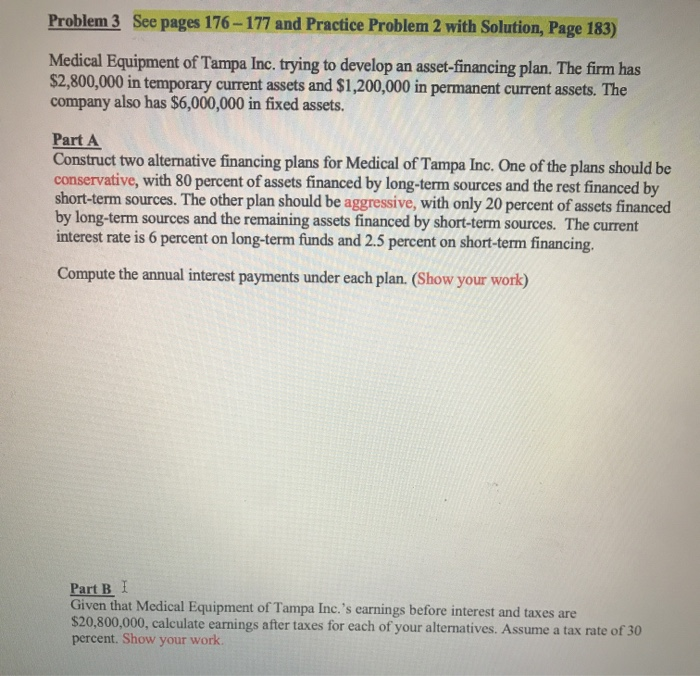

Problem 3 See pages 176-177 and Practice Problem 2 with Solution, Page 183) Medical Equipment of Tampa Inc. trying to develop an asset-financing plan. The firm has $2,800,000 in temporary current assets and $1,200,000 in permanent current assets. The company also has $6,000,000 in fixed assets. Part A Construct two alternative financing plans for Medical of Tampa Inc. One of the plans should be conservative, with 80 percent of assets financed by long-term sources and the rest financed by short-term sources. The other plan should be aggressive, with only 20 percent of assets financed by long-term sources and the remaining assets financed by short-term sources. The current interest rate is 6 percent on long-term funds and 2.5 percent on short-term financing. Compute the annual interest payments under each plan. (Show your work) Part B I Given that Medical Equipment of Tampa Inc.'s earnings before interest and taxes are $20,800,000, calculate earnings after taxes for each of your alternatives. Assume a tax rate of 30 percent. Show your work. Problem 3 See pages 176-177 and Practice Problem 2 with Solution, Page 183) Medical Equipment of Tampa Inc. trying to develop an asset-financing plan. The firm has $2,800,000 in temporary current assets and $1,200,000 in permanent current assets. The company also has $6,000,000 in fixed assets. Part A Construct two alternative financing plans for Medical of Tampa Inc. One of the plans should be conservative, with 80 percent of assets financed by long-term sources and the rest financed by short-term sources. The other plan should be aggressive, with only 20 percent of assets financed by long-term sources and the remaining assets financed by short-term sources. The current interest rate is 6 percent on long-term funds and 2.5 percent on short-term financing. Compute the annual interest payments under each plan. (Show your work) Part B I Given that Medical Equipment of Tampa Inc.'s earnings before interest and taxes are $20,800,000, calculate earnings after taxes for each of your alternatives. Assume a tax rate of 30 percent. Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts