Question: Problem 3: Two-stage Binomial Options Pricing (5 points) A stock with current share price of $20 can either go up or down by $2 in

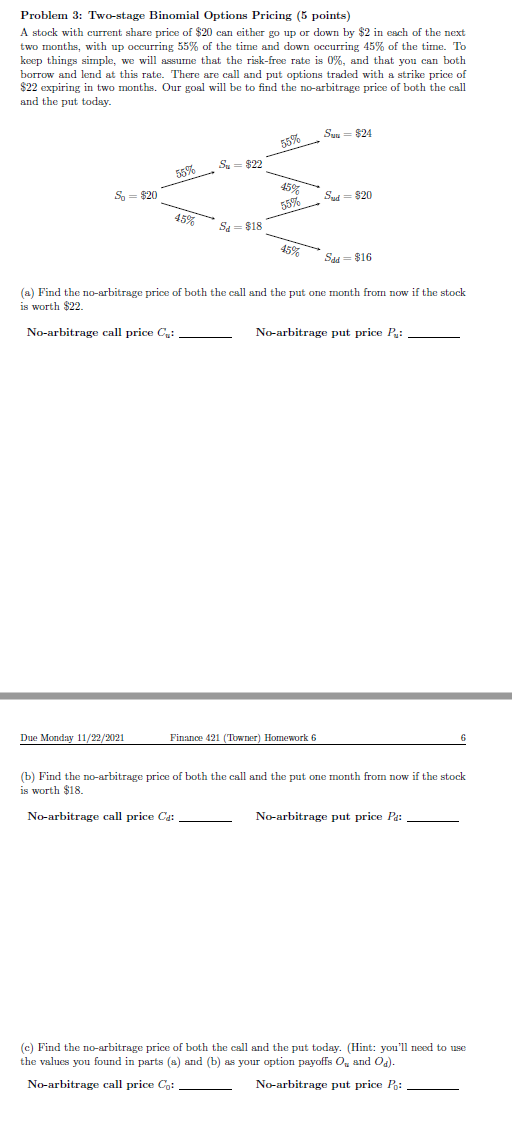

Problem 3: Two-stage Binomial Options Pricing (5 points) A stock with current share price of $20 can either go up or down by $2 in each of the next two months, with up occurring 55% of the time and down occurring 45% of the time. To keep things simple, we will assume that the risk-free rate is 0%, and that you can both borrow and lend at this rate. There are call and put options traded with a strike price of $22 expiring in two months. Our goal will be to find the no-arbitrage price of both the call and the put today. Su=$24 55% Sy = $22 55% 459 So = $20 Sud-820 45% Se818 45% Sod=$16 both the call and the put one month from now if the stock (a) Find the no-arbitrage price is worth $22. No-arbitrage call price : No-arbitrage put price Pu: Due Monday 11/22/2021 Finance 421 (Towner) Homework 6 (b) Find the no-arbitrage price of both the call and the put one month from now if the stock is worth $18. No-arbitrage call price Cd: No-arbitrage put price Pa: (c) Find the no-arbitrage price of both the call and the put today. (Hint: you'll need to use the values you found in parts (8) and (b) as your option payoffs O and Od). No-arbitrage call price Co: No-arbitrage put price Po

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts