Question: Problem 3: Two-stage Binomial Options Pricing (5 points) A stock with current share price of $20 can either go up or down by $2 in

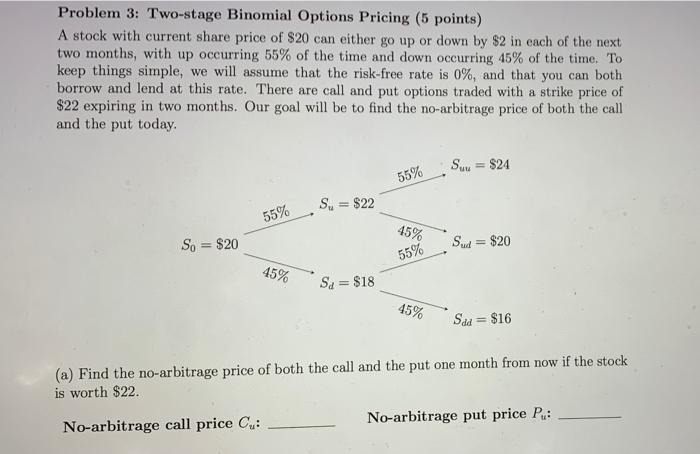

Problem 3: Two-stage Binomial Options Pricing (5 points) A stock with current share price of $20 can either go up or down by $2 in each of the next two months, with up occurring 55% of the time and down occurring 45% of the time. To keep things simple, we will assume that the risk-free rate is 0%, and that you can both borrow and lend at this rate. There are call and put options traded with a strike price of $22 expiring in two months. Our goal will be to find the no-arbitrage price of both the call and the put today. Su = $24 55% Su=$22 55% 45% So = $20 Sud = $20 55% 45% Sc = $18 45% Sa = $16 (a) Find the no-arbitrage price of both the call and the put one month from now if the stock is worth $22. No-arbitrage call price : No-arbitrage put price P: (b) Find the no-arbitrage price of both the call and the put one month from now if the stock is worth $18. No-arbitrage call price Ca: No-arbitrage put price Pa: (c) Find the no-arbitrage price of both the call and the put today. (Hint: you'll need to use the values you found in parts (a) and (b) as your option payoffs 0, and O2). No-arbitrage call price Co: No-arbitrage put price Po

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts