Question: Problem 3.57 Concord Bikes (CB) manufactures and sells two models of bike, Ezee and Focus. Of CB's sales, 60% are for EZee and 40% for

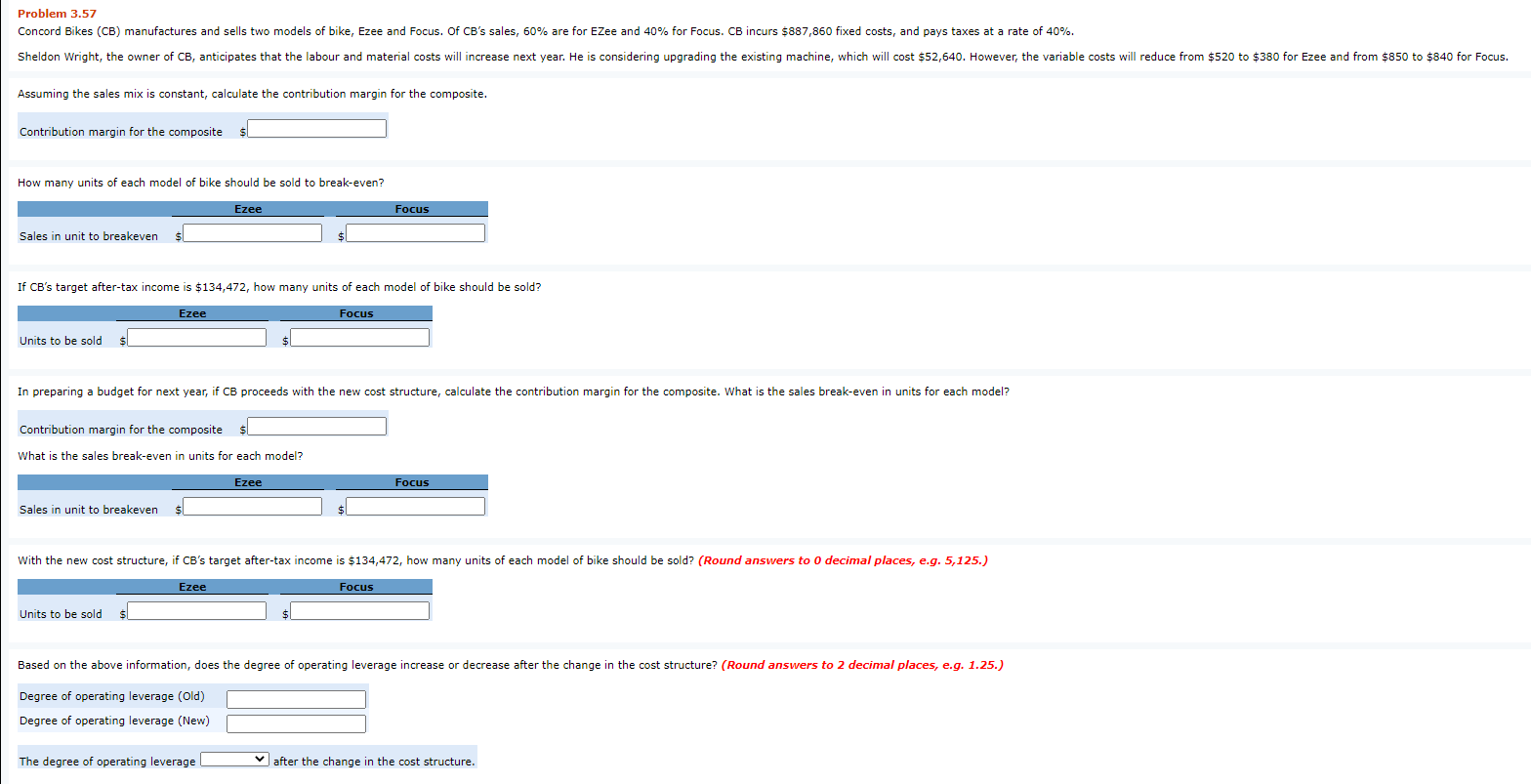

Problem 3.57 Concord Bikes (CB) manufactures and sells two models of bike, Ezee and Focus. Of CB's sales, 60% are for EZee and 40% for Focus. CB incurs $887,860 fixed costs, and pays taxes at a rate of 40%. Sheldon Wright, the owner of CB, anticipates that the labour and material costs will increase next year. He is considering upgrading the existing machine, which will cost $52,640. However, the variable costs will reduce from $520 to $380 for Ezee and from $850 to $840 for Focus. Assuming the sales mix is constant, calculate the contribution margin for the composite. Contribution margin for the composite s How many units of each model of bike should be sold to break-even? Ezee Focus Sales in unit to breakeven If CB's target after-tax income is $134,472, how many units of each model of bike should be sold? Ezee Focus Units to be sold In preparing a budget for next year, if CB proceeds with the new cost structure, calculate the contribution margin for the composite. What is the sales break-even in units for each model? Contribution margin for the composite What is the sales break-even in units for each model? Ezee Focus Sales in unit breakeven With the new cost structure, if CB's target after-tax income is $134,472, how many units of each model of bike should be sold? (Round answers to 0 decimal places, e.g. 5,125.) Ezee Focus Units to be sold Based on the above information, does the degree of operating leverage increase or decrease after the change in the cost structure? (Round answers to 2 decimal places, e.g. 1.25.) Degree of operating leverage (Old) Degree of operating leverage (New) The degree of operating leverage after the change in the cost structure. Problem 3.57 Concord Bikes (CB) manufactures and sells two models of bike, Ezee and Focus. Of CB's sales, 60% are for EZee and 40% for Focus. CB incurs $887,860 fixed costs, and pays taxes at a rate of 40%. Sheldon Wright, the owner of CB, anticipates that the labour and material costs will increase next year. He is considering upgrading the existing machine, which will cost $52,640. However, the variable costs will reduce from $520 to $380 for Ezee and from $850 to $840 for Focus. Assuming the sales mix is constant, calculate the contribution margin for the composite. Contribution margin for the composite s How many units of each model of bike should be sold to break-even? Ezee Focus Sales in unit to breakeven If CB's target after-tax income is $134,472, how many units of each model of bike should be sold? Ezee Focus Units to be sold In preparing a budget for next year, if CB proceeds with the new cost structure, calculate the contribution margin for the composite. What is the sales break-even in units for each model? Contribution margin for the composite What is the sales break-even in units for each model? Ezee Focus Sales in unit breakeven With the new cost structure, if CB's target after-tax income is $134,472, how many units of each model of bike should be sold? (Round answers to 0 decimal places, e.g. 5,125.) Ezee Focus Units to be sold Based on the above information, does the degree of operating leverage increase or decrease after the change in the cost structure? (Round answers to 2 decimal places, e.g. 1.25.) Degree of operating leverage (Old) Degree of operating leverage (New) The degree of operating leverage after the change in the cost structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts