Question: Problem 4 - 3 5 ( Static ) Comprehensive Problem: Wholly Owned Subsidiary LO 4 - 5 Prime Corporation acquired 1 0 0 percent ownership

Problem Static Comprehensive Problem: Wholly Owned Subsidiary LO

Prime Corporation acquired percent ownership of Steak Products Company on January times for $ On that date, Steak reported retained earnings of $ and had $ of common stock outstanding. Prime has used the equity method in accounting for its investment in Steak.

The trial balances for the two companies on December X appear below:

tableItemPrime Corporation,Steak Products CompanyDebitCredit,Debit,CreditCash and Receivables,$ $ InventoryLandBuildings and Equipment,Investment in Steak Products,Cost of Goods Sold,Depreciation Expense,Inventory Losses,Dividends Declared,Accumulated Depreciation,,$ $ Accounts Payable,,Notes Payable,,Common Stock,,Retained Earnings,,SalesIncome from Steak Products,,$$ $$

Additional Information:

On the date of combination five years ago the fair value of Steak's depreciable assets was $ more than the book value. Accumulated depreciation at that

Required:

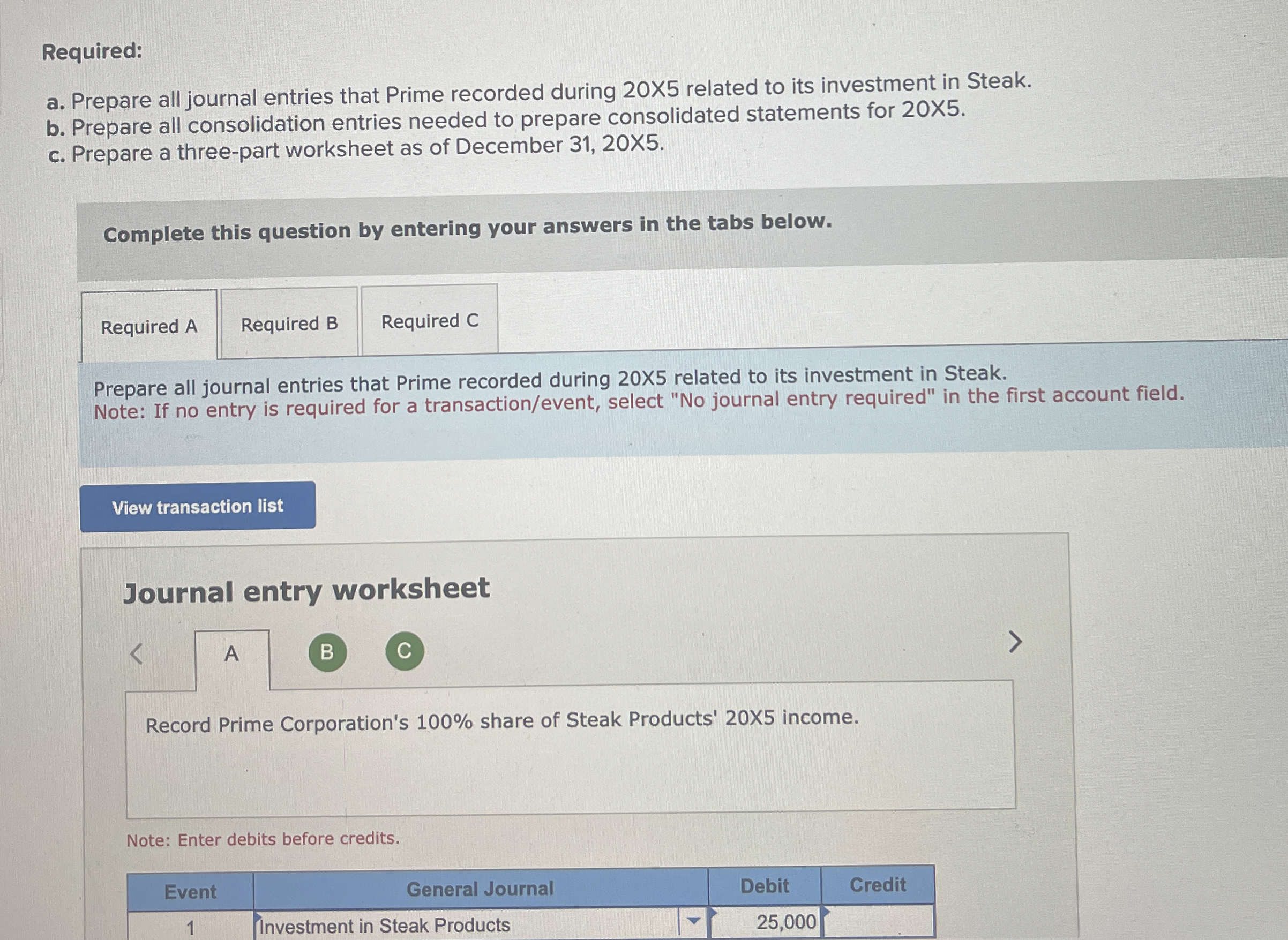

a Prepare all journal entries that Prime recorded during related to its investment in Steak.

b Prepare all consolidation entries needed to prepare consolidated statements for X

c Prepare a threepart worksheet as of December

Complete this question by entering your answers in the tabs below.

Prepare all journal entries that Prime recorded during X related to its investment in Steak.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record Prime Corporation's share of Steak Products' income.

Note: Enter debits before credits.date was $ The differential assigned to depreciable assets should be written off over the following year period.

There was $ of intercorporate receivables and payables at the end of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock