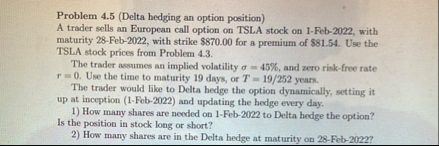

Question: Problem 4 . 5 ( Delta hedging an option position ) A trader sells an European call option on TSLA stock on 1 - Feb

Problem Delta hedging an option position

A trader sells an European call option on TSLA stock on Feb with maturity Feb with strike $ for a premium of $ Use the TSLA stock prices from Problem

The trader assumes an implied volatility and zero riskfree rate Use the time to maturity days, or years.

The trader would like to Delta hedge the option dynamically, setting it up at inception Feb and updating the hedge every day.

How many shares are needed on Feb to Delta hedge the option? Is the position in stock long or short?

How many shares are in the Delta hedge at maturity on Feb

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock