Question: Problem 4: Consider the model constituted by three stocks, and there are three scenarios wi,w2 and wz occur with probabilities 1/6, 1/2, and 1/3 respectively.

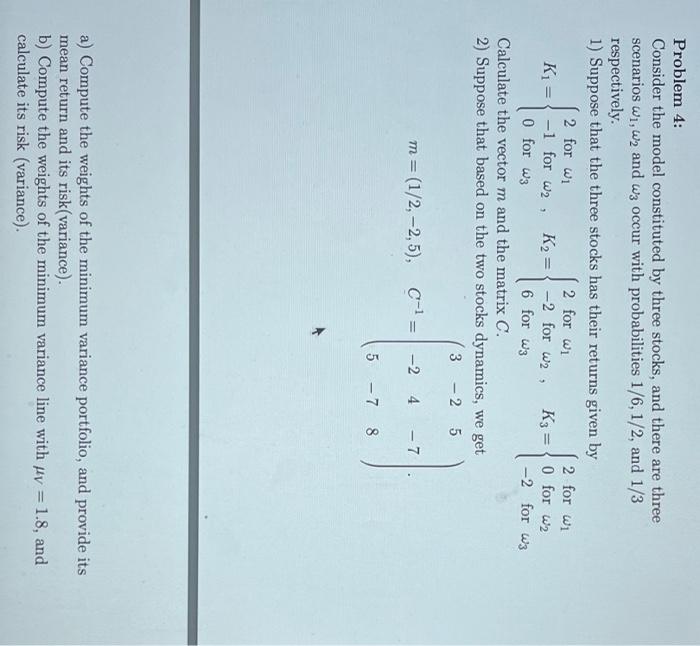

Problem 4: Consider the model constituted by three stocks, and there are three scenarios wi,w2 and wz occur with probabilities 1/6, 1/2, and 1/3 respectively. 1) Suppose that the three stocks has their returns given by 2 for Wi 2 for wi K = -1 for w2, K2 = -2 for w2, K3 = O for w2 0 for w3 6 for w3 -2 for w3 Calculate the vector m and the matrix C. 2) Suppose that based on the two stocks dynamics, we get 3 - 2 5 2 for w1 m= (1/2, -2,5), C-1 = - -2 4 - 7 5-7 8 a) Compute the weights of the minimum variance portfolio, and provide its mean return and its risk(variance). b) Compute the weights of the minimum variance line with my = 1.8, and calculate its risk (variance). Problem 4: Consider the model constituted by three stocks, and there are three scenarios wi,w2 and wz occur with probabilities 1/6, 1/2, and 1/3 respectively. 1) Suppose that the three stocks has their returns given by 2 for Wi 2 for wi K = -1 for w2, K2 = -2 for w2, K3 = O for w2 0 for w3 6 for w3 -2 for w3 Calculate the vector m and the matrix C. 2) Suppose that based on the two stocks dynamics, we get 3 - 2 5 2 for w1 m= (1/2, -2,5), C-1 = - -2 4 - 7 5-7 8 a) Compute the weights of the minimum variance portfolio, and provide its mean return and its risk(variance). b) Compute the weights of the minimum variance line with my = 1.8, and calculate its risk (variance)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts