Question: Problem 4: Holding Period Returns (4 points) A stock has expected return of 2% per quarter and expected dividend growth of 1% per quarter, both

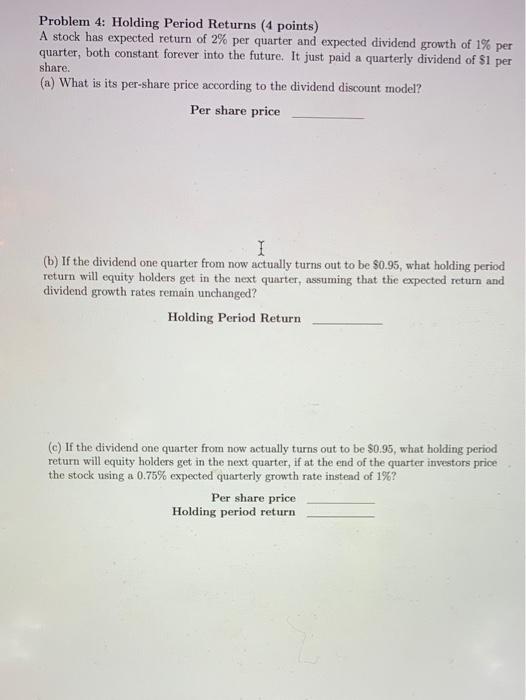

Problem 4: Holding Period Returns (4 points) A stock has expected return of 2% per quarter and expected dividend growth of 1% per quarter, both constant forever into the future. It just paid a quarterly dividend of $1 per share. (a) What is its per-share price according to the dividend discount model? Per share price I 1 (b) If the dividend one quarter from now actually turns out to be $0.95, what holding period return will equity holders get in the next quarter, assuming that the expected return and dividend growth rates remain unchanged? Holding Period Return (c) If the dividend one quarter from now actually turns out to be $0.95, what holding period return will equity holders get in the next quarter, if at the end of the quarter investors price the stock using a 0.75% expected quarterly growth rate instead of 1%? Per share price Holding period return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts