Question: Problem 4: Portfolio Choice with 2 Riskless Assets (1 point) Investors like expected return and dislike variance. Assume that investors can allocate their wealth across

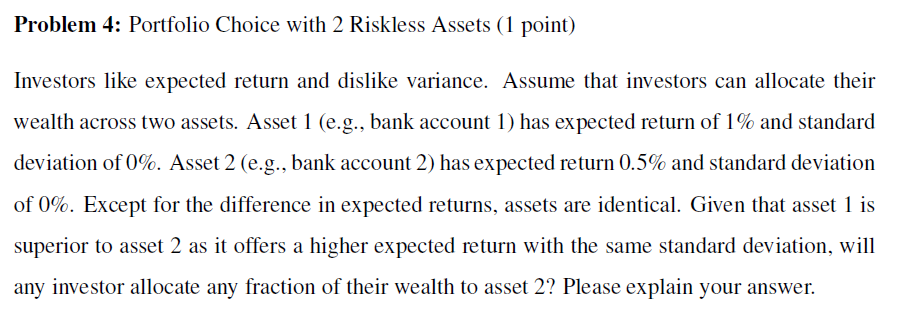

Problem 4: Portfolio Choice with 2 Riskless Assets (1 point) Investors like expected return and dislike variance. Assume that investors can allocate their wealth across two assets. Asset 1 (e.g., bank account 1) has expected return of 1% and standard deviation of 0%. Asset 2 (e.g., bank account 2) has expected return 0.5% and standard deviation of 0%. Except for the difference in expected returns, assets are identical. Given that asset 1 is superior to asset 2 as it offers a higher expected return with the same standard deviation, will any investor allocate any fraction of their wealth to asset 2? Please explain your answer. Problem 4: Portfolio Choice with 2 Riskless Assets (1 point) Investors like expected return and dislike variance. Assume that investors can allocate their wealth across two assets. Asset 1 (e.g., bank account 1) has expected return of 1% and standard deviation of 0%. Asset 2 (e.g., bank account 2) has expected return 0.5% and standard deviation of 0%. Except for the difference in expected returns, assets are identical. Given that asset 1 is superior to asset 2 as it offers a higher expected return with the same standard deviation, will any investor allocate any fraction of their wealth to asset 2? Please explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts