Question: Problem 5: Risk-return trade-off (4 points) Investors like expected return and dislike variance. a) (1 point) There are 2 assets available: Expected return Standard deviation

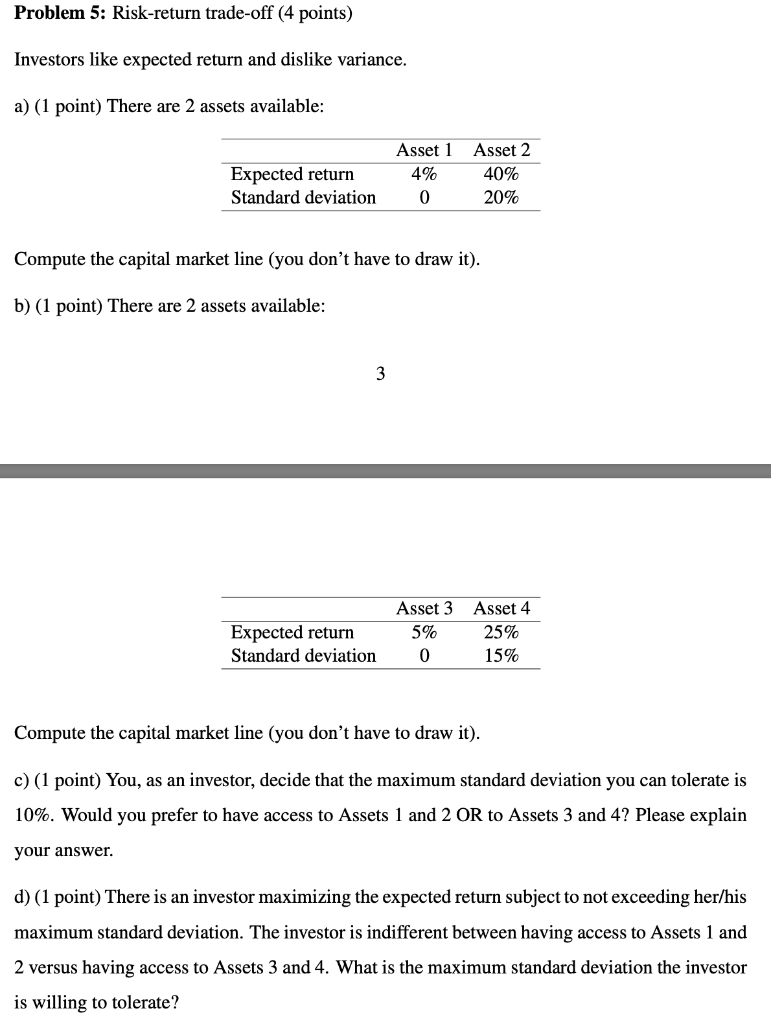

Problem 5: Risk-return trade-off (4 points) Investors like expected return and dislike variance. a) (1 point) There are 2 assets available: Expected return Standard deviation Asset 1 4% 0 Asset 2 40% 20% Compute the capital market line (you don't have to draw it). b) (1 point) There are 2 assets available: 3 Expected return Standard deviation Asset 3 5% 0 Asset 4 25% 15% Compute the capital market line (you don't have to draw it). c) (1 point) You, as an investor, decide that the maximum standard deviation you can tolerate is 10%. Would you prefer to have access to Assets 1 and 2 OR to Assets 3 and 4? Please explain your answer. d) (1 point) There is an investor maximizing the expected return subject to not exceeding her/his maximum standard deviation. The investor is indifferent between having access to Assets 1 and 2 versus having access to Assets 3 and 4. What is the maximum standard deviation the investor is willing to tolerate? Problem 5: Risk-return trade-off (4 points) Investors like expected return and dislike variance. a) (1 point) There are 2 assets available: Expected return Standard deviation Asset 1 4% 0 Asset 2 40% 20% Compute the capital market line (you don't have to draw it). b) (1 point) There are 2 assets available: 3 Expected return Standard deviation Asset 3 5% 0 Asset 4 25% 15% Compute the capital market line (you don't have to draw it). c) (1 point) You, as an investor, decide that the maximum standard deviation you can tolerate is 10%. Would you prefer to have access to Assets 1 and 2 OR to Assets 3 and 4? Please explain your answer. d) (1 point) There is an investor maximizing the expected return subject to not exceeding her/his maximum standard deviation. The investor is indifferent between having access to Assets 1 and 2 versus having access to Assets 3 and 4. What is the maximum standard deviation the investor is willing to tolerate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts