Question: Problem 4. Your uncle, Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $20,000 in the

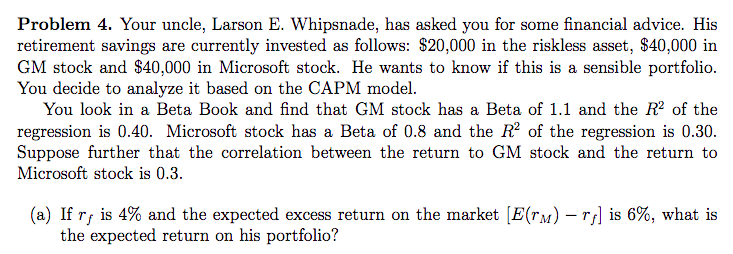

Problem 4. Your uncle, Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $20,000 in the riskless asset, $40,000 in GM stock and $40,000 in Microsoft stock. He wants to know if this is a sensible portfolio. You decide to analyze it based on the CAPM model. You look in a Beta Book and find that GM stock has a Beta of 1.1 and the R of the regression is 0.40. Microsoft stock has a Beta of 0.8 and the R of the regression is 0.30. Suppose further that the correlation between the return to GM stock and the return to Microsoft stock is 0.3. (a) If r, is 4% and the expected excess return on the market [E(rm) - ry] is 6%, what is the expected return on his portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts