Question: Problem 4-13 Net Operating Losses (LO 4.9) Tyler, a single taxpayer, generates business Income of $3,000 in 2016. In 2017, he generates on NOL of

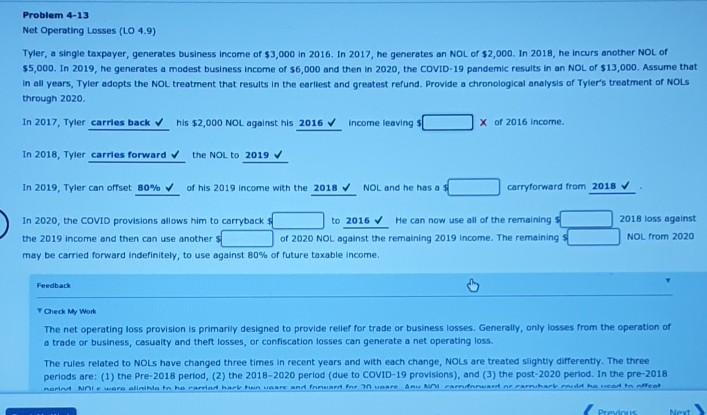

Problem 4-13 Net Operating Losses (LO 4.9) Tyler, a single taxpayer, generates business Income of $3,000 in 2016. In 2017, he generates on NOL of $2,000. In 2018, he Incurs another NOL of $5,000. In 2019, he generates a modest business Income of $6,000 and then in 2020, the COVID-19 pandemic results in an NOL OF $13,000. Assume that in all years, Tyler adopts the NOL treatment that results in the earliest and greatest refund. Provide a chronological analysis of Tyler's treatment of NOLS through 2020 In 2017, Tyler carries back his $2,000 NOL against his 2016 Income leaving 5 X of 2016 Income. In 2018, Tyler carries forward the NOL to 2019 In 2019, Tyler can offset 80% of his 2019 Income with the 2018 NOL and he has a carryforward from 2018 In 2020, the COVIO provisions allows him to carryback to 2016 He can now use all of the remaining the 2019 income and then can use another of 2020 NOL against the remaining 2019 Income. The remaining may be carried forward indefinitely, to use against 80% of future taxable income, 2018 loss against NOL from 2020 Feedback Check My Work The net operating loss provision is primarily designed to provide reller for trade or business losses, Generally, only losses from the operation of trade or business, Casualty and theft losses, or confiscation losses can generate a net operating loss. The rules related to NOLS have changed three times in recent years and with each change, NOLs are treated slightly differently. The three periods are: (1) the Pre-2018 period, (2) the 2018-2020 period (due to COVID-19 provisions), and (3) the post-2020 period. In the pre-2018 ROMA NOI wore allaithe rainst here and find neare care ne maradhat went Previous Net

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts