Question: Problem 4-13 Net Operating Losses (LO 4.9) Tyler, a single taxpayer, generates business income of $3,000 in 2016. In 2017, he generates an NOL of

Problem 4-13 Net Operating Losses (LO 4.9)

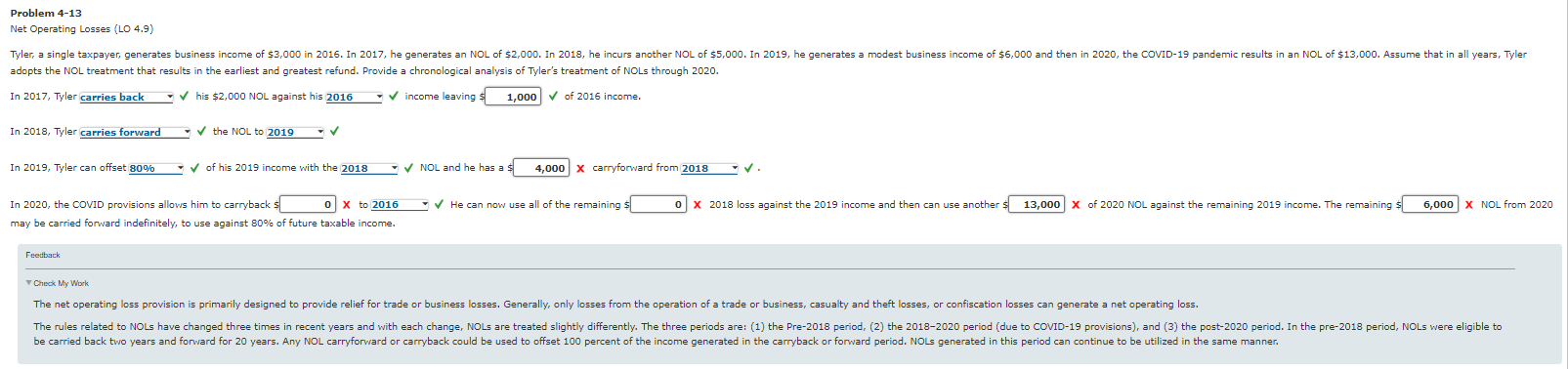

Tyler, a single taxpayer, generates business income of $3,000 in 2016. In 2017, he generates an NOL of $2,000. In 2018, he incurs another NOL of $5,000. In 2019, he generates a modest business income of $6,000 and then in 2020, the COVID-19 pandemic results in an NOL of $13,000. Assume that in all years, Tyler adopts the NOL treatment that results in the earliest and greatest refund. Provide a chronological analysis of Tylers treatment of NOLs through 2020.

adopts the NOL treatment that results in the earliest and greatest refund. Provide a chronological analysis of Tyler's treatment of NOLs through 2020. In 2017, Tyler his $2,000 NOL against his 20 : income leaving : 2016 income. Theck My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts