Question: Problem 4-21 Calculating Future Values [LO 1 ] You have $5,000 to deposit. Regency Bank offers 15 percent per year compounded monthly (1.25 percent per

![Problem 4-21 Calculating Future Values [LO 1 ] You have $5,000](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd1e16d3356_34266fd1e16740b2.jpg)

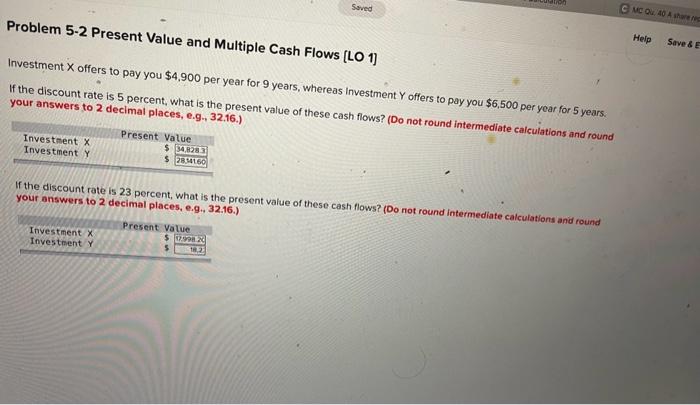

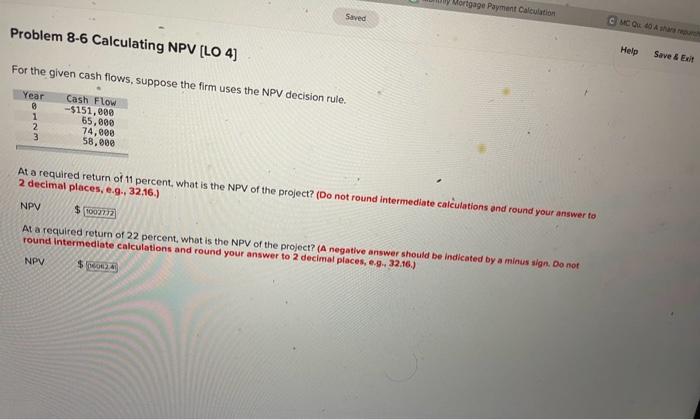

Problem 4-21 Calculating Future Values [LO 1 ] You have $5,000 to deposit. Regency Bank offers 15 percent per year compounded monthly (1.25 percent per month), while King Bank offers 15 percent but will only compound annually. How much will your investment be worth in 20 years at each Bank? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Problem 5-2 Present Value and Multiple Cash Flows [LO 1] Investment X offers to pay you $4,900 per year for 9 years, whereas Investment Y offers to pay you $6,500 per year for 5 years. If the discount rate is 5 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places. on 2 2.16.) If the discount rate is 23 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) For the given cash flows. suppose the firm uses the NPV decision rule. At a required return of 11 percent, what is the NPV of the project? (Do not round intermediate calculations and round your answer fo 2 decimal places, e.g., 32,16.) NPV $ At a required return of 22 percent, whet is the NPV of the project? (A negative answer should be indicated by a minus aign, Do nor round intermediate calculations and round your answer to 2 decimal places, e.9. 32.46 .) NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts