Question: Problem 5 (25 Points) A project under consideration costs $200,000, has a five-year life, and has no salvage value. Depreciation is MACRS 5-year [Yr. 1

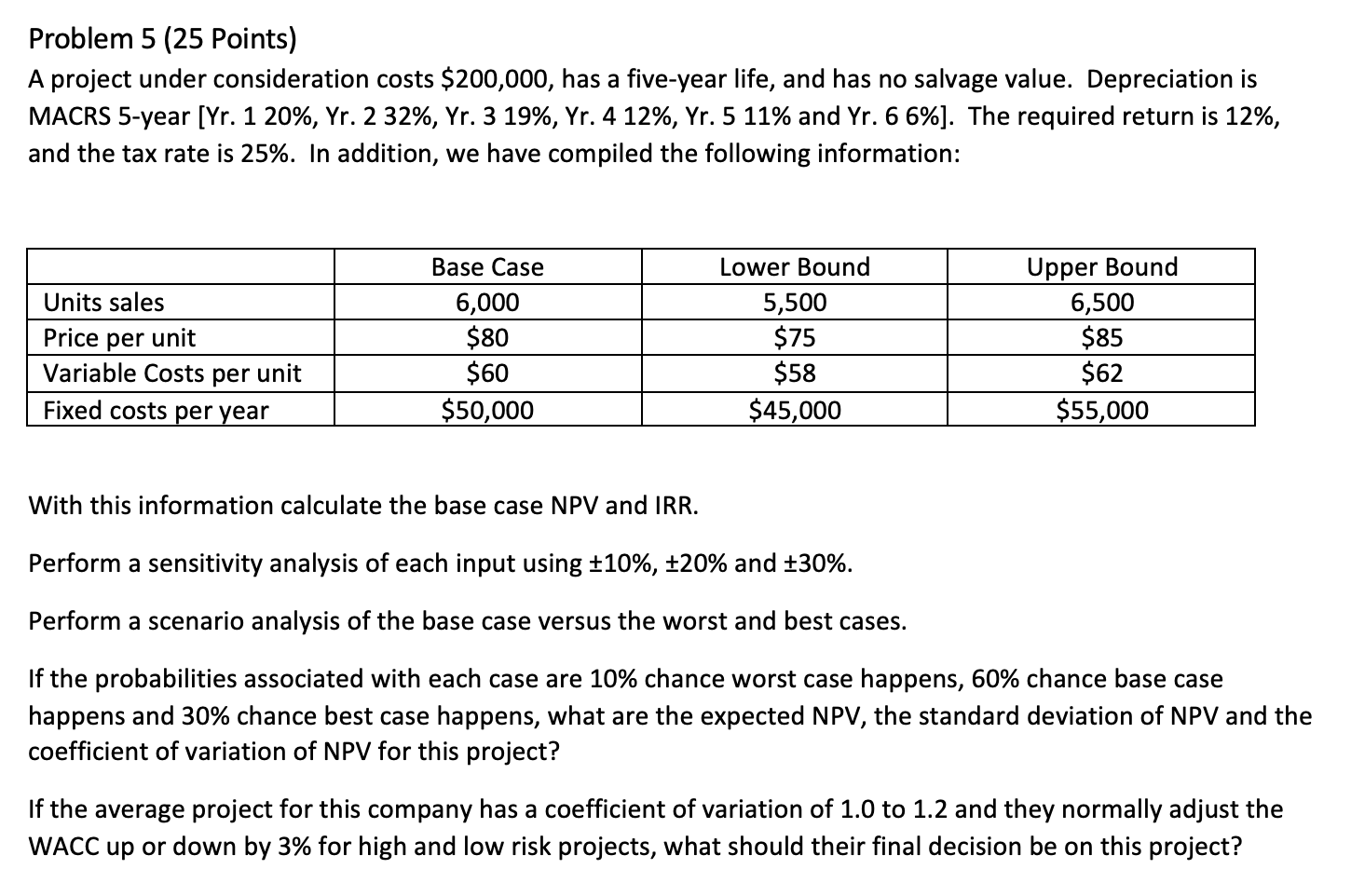

Problem 5 (25 Points) A project under consideration costs $200,000, has a five-year life, and has no salvage value. Depreciation is MACRS 5-year [Yr. 1 20%, Yr. 2 32%, Yr. 3 19%, Yr. 4 12%, Yr. 5 11% and Yr. 6 6%). The required return is 12%, and the tax rate is 25%. In addition, we have compiled the following information: Units sales Price per unit Variable Costs per unit Fixed costs per year Base Case 6,000 $80 $60 $50,000 Lower Bound 5,500 $75 $58 $45,000 Upper Bound 6,500 $85 $62 $55,000 With this information calculate the base case NPV and IRR. Perform a sensitivity analysis of each input using +10%, +20% and +30%. Perform a scenario analysis of the base case versus the worst and best cases. If the probabilities associated with each case are 10% chance worst case happens, 60% chance base case happens and 30% chance best case happens, what are the expected NPV, the standard deviation of NPV and the coefficient of variation of NPV for this project? If the average project for this company has a coefficient of variation of 1.0 to 1.2 and they normally adjust the WACC up or down by 3% for high and low risk projects, what should their final decision be on this project? Problem 5 (25 Points) A project under consideration costs $200,000, has a five-year life, and has no salvage value. Depreciation is MACRS 5-year [Yr. 1 20%, Yr. 2 32%, Yr. 3 19%, Yr. 4 12%, Yr. 5 11% and Yr. 6 6%). The required return is 12%, and the tax rate is 25%. In addition, we have compiled the following information: Units sales Price per unit Variable Costs per unit Fixed costs per year Base Case 6,000 $80 $60 $50,000 Lower Bound 5,500 $75 $58 $45,000 Upper Bound 6,500 $85 $62 $55,000 With this information calculate the base case NPV and IRR. Perform a sensitivity analysis of each input using +10%, +20% and +30%. Perform a scenario analysis of the base case versus the worst and best cases. If the probabilities associated with each case are 10% chance worst case happens, 60% chance base case happens and 30% chance best case happens, what are the expected NPV, the standard deviation of NPV and the coefficient of variation of NPV for this project? If the average project for this company has a coefficient of variation of 1.0 to 1.2 and they normally adjust the WACC up or down by 3% for high and low risk projects, what should their final decision be on this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts