Question: Problem 5: Investments C and D both offer the same standard deviation. The expected return of C is higher than that of D 's expected

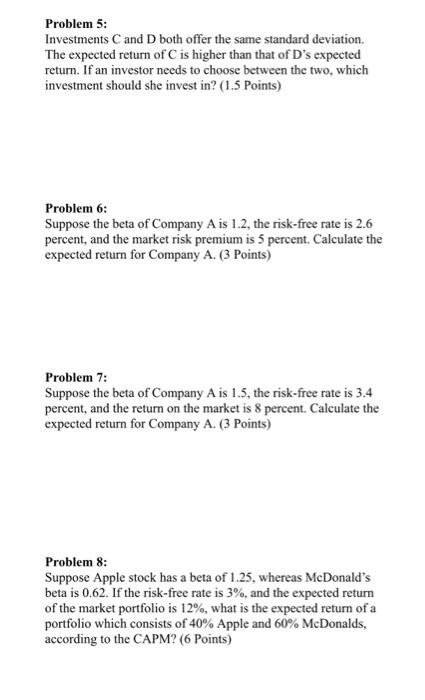

Problem 5: Investments C and D both offer the same standard deviation. The expected return of C is higher than that of D 's expected return. If an investor needs to choose between the two, which investment should she invest in? ( 1.5 Points) Problem 6: Suppose the beta of Company A is 1.2, the risk-free rate is 2.6 percent, and the market risk premium is 5 percent. Calculate the expected return for Company A. (3 Points) Problem 7: Suppose the beta of Company A is 1.5, the risk-free rate is 3.4 percent, and the return on the market is 8 percent. Calculate the expected return for Company A. (3 Points) Problem 8: Suppose Apple stock has a beta of 1.25, whereas McDonald's beta is 0.62. If the risk-free rate is 3%, and the expected return of the market portfolio is 12%, what is the expected return of a portfolio which consists of 40% Apple and 60% McDonalds, according to the CAPM? (6 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts