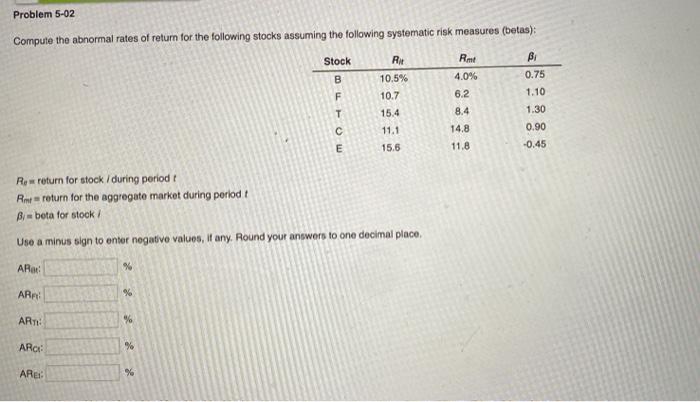

Question: Problem 5-02 Compute the abnormal rates of return for the following stocks assuming the following systematic risk measures (betas); Stock B RE 10.5% 10.7 F

Problem 5-02 Compute the abnormal rates of return for the following stocks assuming the following systematic risk measures (betas); Stock B RE 10.5% 10.7 F Rim 4.0% 6.2 8.4 14.8 11.8 BA 0.75 1.10 1.30 0.90 T 15.4 11.1 E 15,6 -0.45 Rewreturn for stock during period Rmtreturn for the aggregate market during period B = beta for stock / Use a minus sign to enter negative values, if any, Round your answers to one decimal place AR % ARA % ART: % ARC % ARE %

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock