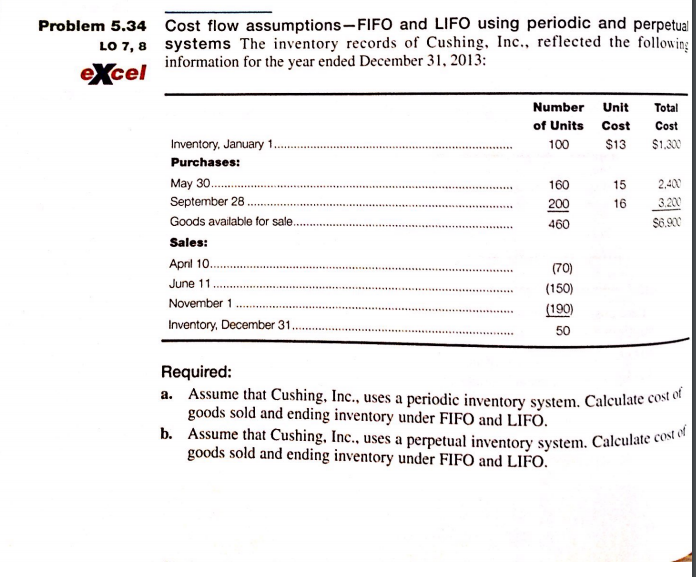

Question: Problem 5.34 Cost flow assumptions-FIFO and LIFO using periodic and perpetual Lo 7, 8 systems The inventory records of Cushing, Inc., reflected the following information

Problem 5.34 Cost flow assumptions-FIFO and LIFO using periodic and perpetual Lo 7, 8 systems The inventory records of Cushing, Inc., reflected the following information for the year ended December 31, 2013: e Cel Number Unit Total of Units Cost Cost Inventory, January 1. 100 $13 $1.300 Purchases: May 30... 160 15 2.400 September 28 3,200 200 16 Goods available for sale. 460 $0.900 Sales: Apnl 10. (70) June 11 (150) November 1 Inventory, December 31. Required: a. Assume that Cushing, Inc., uses a periodic inventory system. Ca cost of goods sold and ending inventory under FIFO and LIFo. b. Assume that Cushing, Inc., uses a perpetual inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts