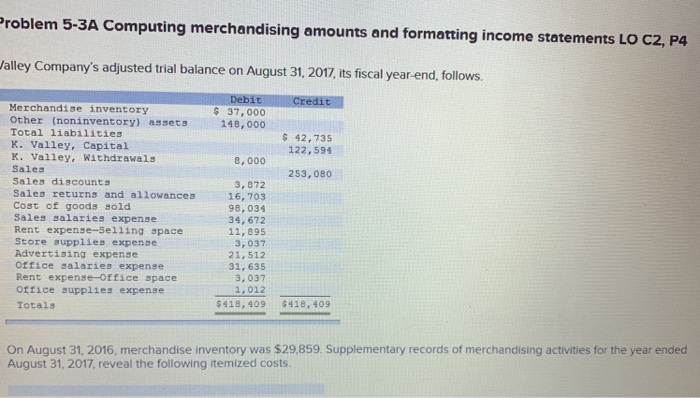

Question: Problem 5-3A Computing merchandising amounts and formatting income statements LO C2, P4 alley Company's adjusted trial balance on August 31, 2017, ts fiscal year-end, follows

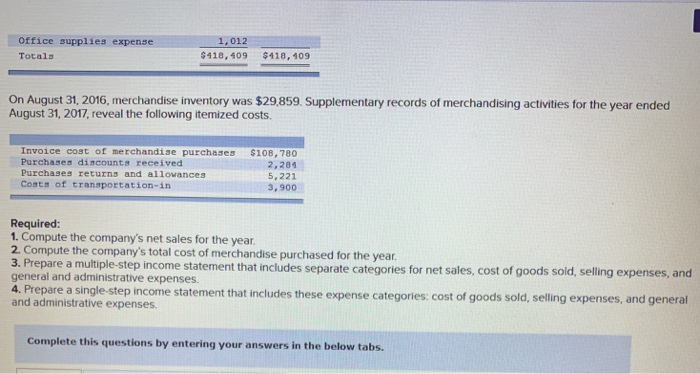

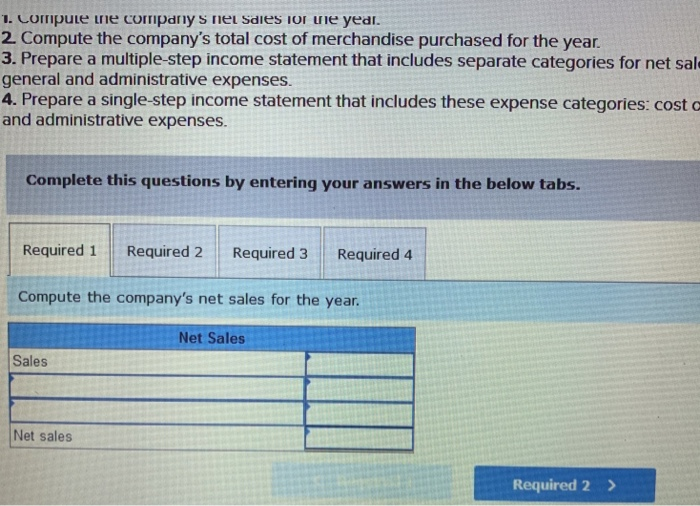

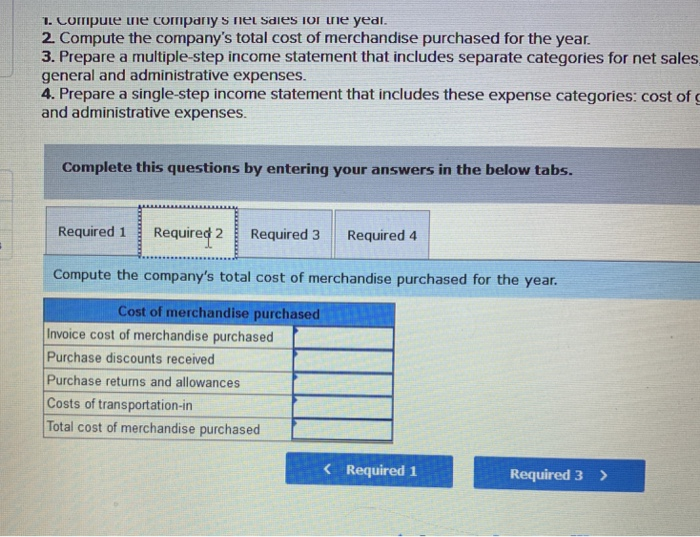

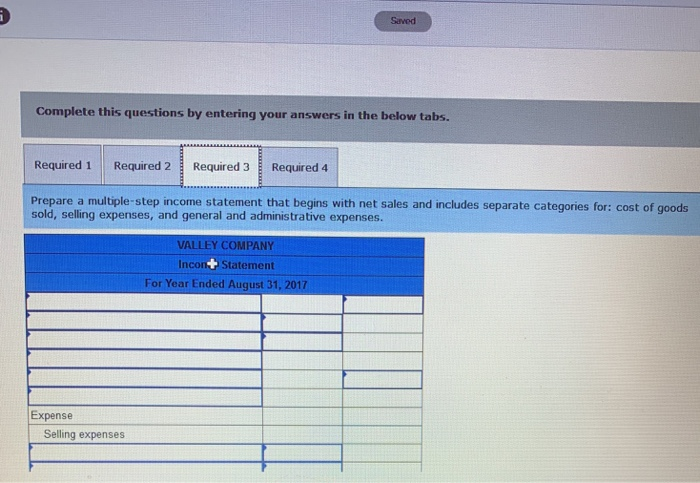

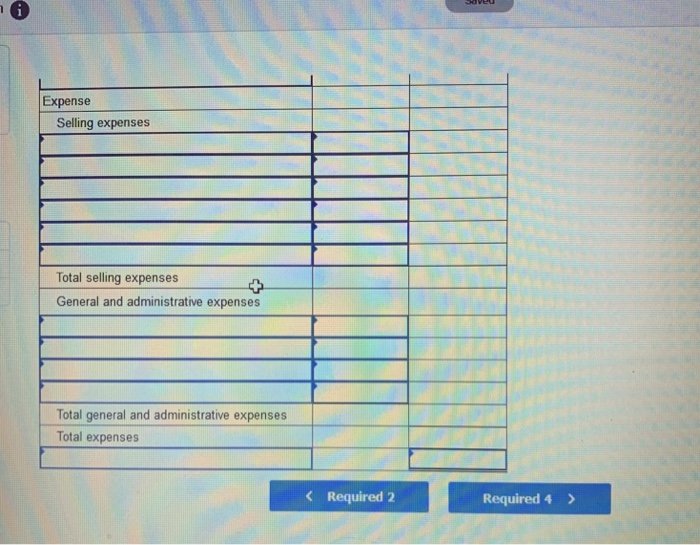

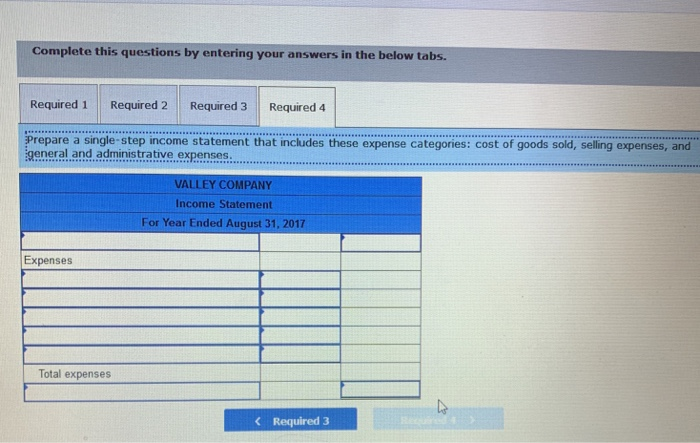

Problem 5-3A Computing merchandising amounts and formatting income statements LO C2, P4 alley Company's adjusted trial balance on August 31, 2017, ts fiscal year-end, follows Merchandise inventory Other (noninventory) assets Total liabilities K. Valley, Capital K. Valley, Withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense office salaries expense Rent expense-office space office supplies expense Totals S37,000 148,000 s 42,735 8, 000 000 122,59 253,080 3, 872 16, 703 98,034 34, 672 11,895 3, 037 21, 512 31, 635 3,037 1,012 $418,409 $418,409 On August 31, 2016, merchandise inventory was $29,859. Supplementary records of merchandising activities for the year ended August 31, 2017, reveal the following itemized costs. Office supplies expense 1,012 $418,409 $418, 109 Totals On August 31, 2016, merchandise inventory was $29,859. Supplementary records of merchandising activities for the year ended August 31, 2017, reveal the following itemized costs. Invoice cost of merchandise purchases $108,780 Purchases discounts received Purchases returns and allovances Costa of transportation-in 2,284 5,221 3,900 Required: 1. Compute the company's net sales for the year 2. Compute the company's total cost of merchandise purchased for the year. epare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. rPrepare a singe p income statement that includes these expense categories: cost of goods sold, seling expenses, and general and administrative expenses Complete this questions by entering your answers in the below tabs. te ue comparny s net sd 2. Compute the company's total cost of merchandise purchased for the year 3. Prepare a multiple-step income statement that includes separate categories for net sal general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost a and administrative expenses. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Required 4 Compute the company's net sales for the year Net Sales Sales Net sales Required 2> 1. Commpute ie Compdry s riel Sdies IOI ie yedl. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of and administrative expenses. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Required Compute the company's total cost of merchandise purchased for the year Cost of merchandise purchased Invoice cost of merchandise purchased Purchase discounts received Purchase returns and allowances Costs of transportation-in Total cost of merchandise purchased K Required 1 Required3 > Saved Complete this questions by entering your answers in the below tabs Required 1 Required 2Required 3 Required 4 Prepare a multiple-step income statement that begins with net sales and includes separate categories for: cost of goods sold, selling expenses, and general and administrative expenses VALLEY COMPANY IncoStatement For Year Ended August 31, 2017 Expense Selling expenses Expense Selling expenses Total selling expenses General and administrative expenses Total general and administrative expenses Total expenses Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Required 4 Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and.administrative expenses VALLEY COMPANY Income Statement For Year Ended August 31, 2017 Expenses Total expenses K Required 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts