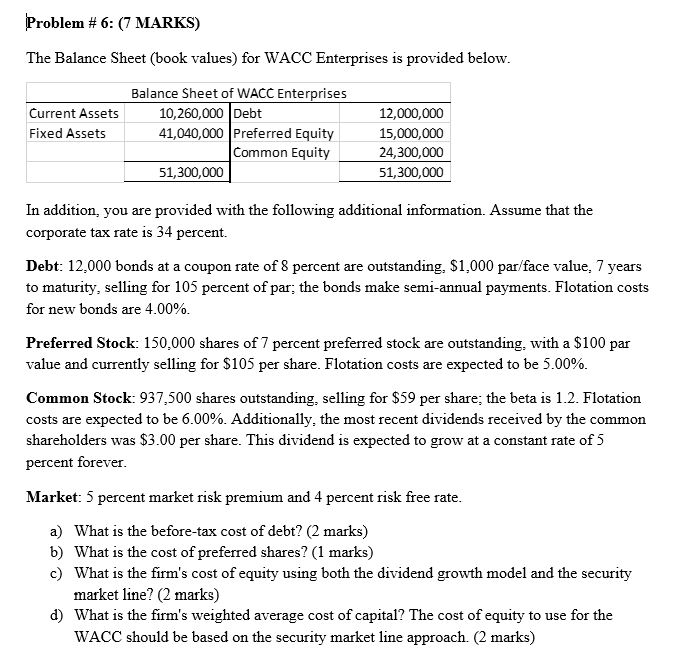

Question: Problem #6: (7 MARKS) The Balance Sheet (book values) for WACC Enterprises is provided below. Current Assets Fixed Assets Balance Sheet of WACC Enterprises 10,260,000

Problem #6: (7 MARKS) The Balance Sheet (book values) for WACC Enterprises is provided below. Current Assets Fixed Assets Balance Sheet of WACC Enterprises 10,260,000 Debt 41,040,000 Preferred Equity Common Equity 51,300,000 12,000,000 15,000,000 24,300,000 51,300,000 In addition, you are provided with the following additional information. Assume that the corporate tax rate is 34 percent. Debt: 12,000 bonds at a coupon rate of 8 percent are outstanding. $1,000 par/face value, 7 years to maturity, selling for 105 percent of par; the bonds make semi-annual payments. Flotation costs for new bonds are 4.00%. Preferred Stock: 150,000 shares of 7 percent preferred stock are outstanding, with a $100 par value and currently selling for $105 per share. Flotation costs are expected to be 5.00%. Common Stock: 937,500 shares outstanding, selling for $59 per share; the beta is 1.2. Flotation costs are expected to be 6.00%. Additionally, the most recent dividends received by the common shareholders was $3.00 per share. This dividend is expected to grow at a constant rate of 5 percent forever. Market: 5 percent market risk premium and 4 percent risk free rate. a) What is the before-tax cost of debt? (2 marks) b) What is the cost of preferred shares? (1 marks) c) What is the firm's cost of equity using both the dividend growth model and the security market line? (2 marks) d) What is the firm's weighted average cost of capital? The cost of equity to use for the WACC should be based on the security market line approach. (2 marks) Problem #6: (7 MARKS) The Balance Sheet (book values) for WACC Enterprises is provided below. Current Assets Fixed Assets Balance Sheet of WACC Enterprises 10,260,000 Debt 41,040,000 Preferred Equity Common Equity 51,300,000 12,000,000 15,000,000 24,300,000 51,300,000 In addition, you are provided with the following additional information. Assume that the corporate tax rate is 34 percent. Debt: 12,000 bonds at a coupon rate of 8 percent are outstanding. $1,000 par/face value, 7 years to maturity, selling for 105 percent of par; the bonds make semi-annual payments. Flotation costs for new bonds are 4.00%. Preferred Stock: 150,000 shares of 7 percent preferred stock are outstanding, with a $100 par value and currently selling for $105 per share. Flotation costs are expected to be 5.00%. Common Stock: 937,500 shares outstanding, selling for $59 per share; the beta is 1.2. Flotation costs are expected to be 6.00%. Additionally, the most recent dividends received by the common shareholders was $3.00 per share. This dividend is expected to grow at a constant rate of 5 percent forever. Market: 5 percent market risk premium and 4 percent risk free rate. a) What is the before-tax cost of debt? (2 marks) b) What is the cost of preferred shares? (1 marks) c) What is the firm's cost of equity using both the dividend growth model and the security market line? (2 marks) d) What is the firm's weighted average cost of capital? The cost of equity to use for the WACC should be based on the security market line approach. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts