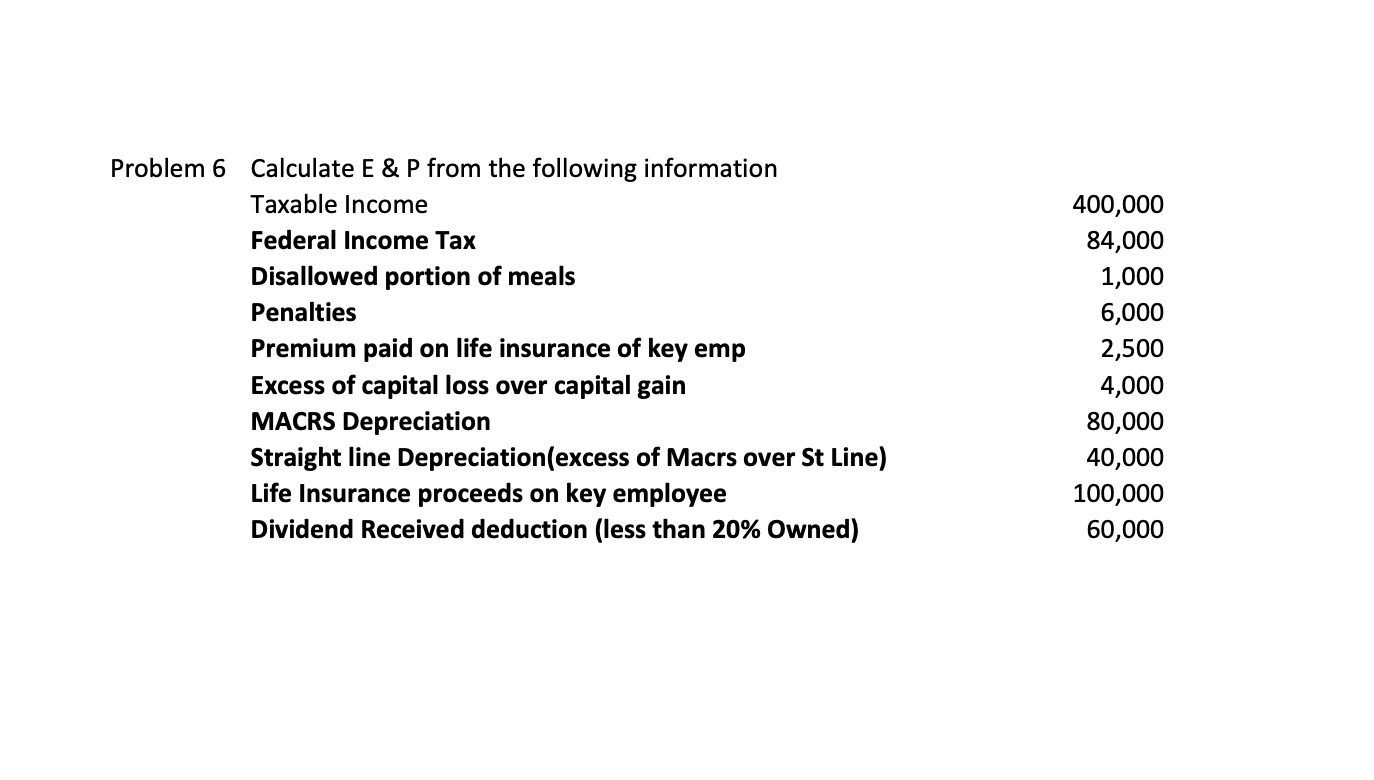

Question: Problem 6 Calculate E & P from the following information Taxable Income Federal Income Tax Disallowed portion of meals Penalties Premium paid on life insurance

Problem 6 Calculate E & P from the following information Taxable Income Federal Income Tax Disallowed portion of meals Penalties Premium paid on life insurance of key emp Excess of capital loss over capital gain MACRS Depreciation Straight line Depreciation(excess of Macrs over St Line) Life Insurance proceeds on key employee Dividend Received deduction (less than 20% Owned) 400,000 84,000 1,000 6,000 2,500 4,000 80,000 40,000 100,000 60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts