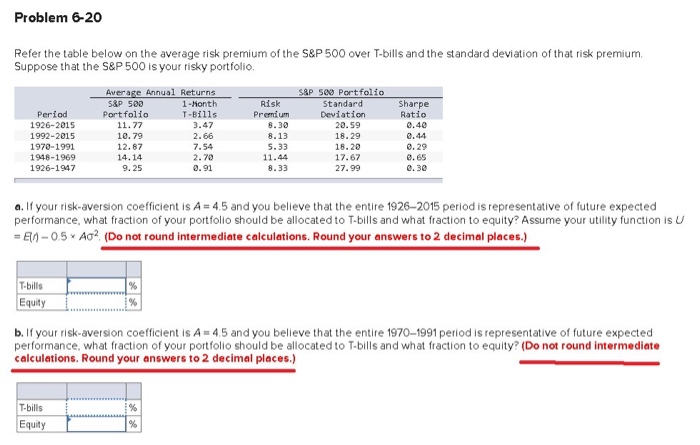

Question: Problem 6-20 Refer the table below on the average risk premium of the S&P 500 over T-bills and the standard deviation of that risk premium.

Problem 6-20 Refer the table below on the average risk premium of the S&P 500 over T-bills and the standard deviation of that risk premium. Suppose that the S&P 500 is your risky portfolio. Average Annual Returns SP s00 Portfolio Standard S&P 500 1-Month Risk Sharpe Ratio T-Bills Period Portfolio Premium Deviation 0.40 1926-2015 1992-2015 11.77 10. 79 3.47 8.30 20.59 0,44 0. 29 0. 65 0.30 2.66 7.54 8.13 18.29 18.20 17.67 1970-1991 12.87 5.33 1948-1969 14.14 2.70 11.44 9. 25 1926-1947 0.91 8.33 27.99 a. If your risk-aversion coefficient is A = 4.5 and you believe that the entire 1926-2015 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? Assume your utility function is U = EA - 0.5 x Ao?. (Do not round intermediate calculations. Round your answers to 2 decimal places.) %3D T-bills Equity b. If your risk-aversion coefficient is A= 4.5 and you believe that the entire 1970-1991 period is representative of future expected performance, what fraction of your portfolio should be allocated to T-bills and what fraction to equity? (Do not round intermediate calculations. Round your answers to 2 decimal places.) T-bills Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts