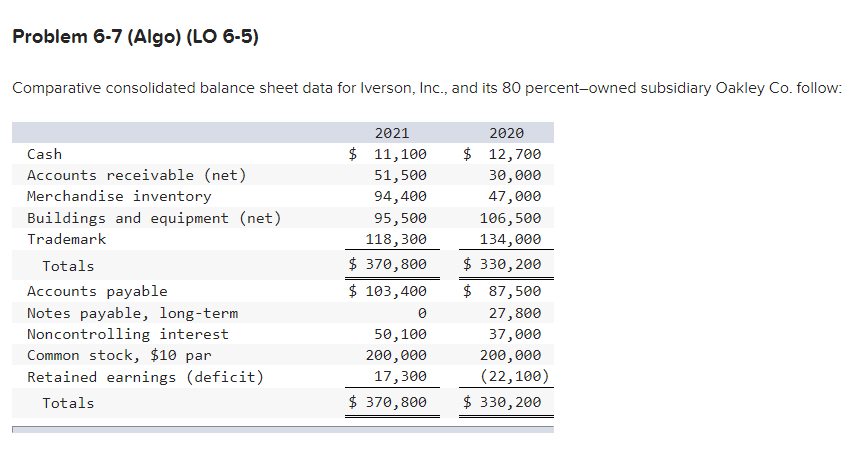

Question: Problem 6-7 (Algo) (LO 6-5) Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent-owned subsidiary Oakley Co. follow: Additional Information for Fiscal

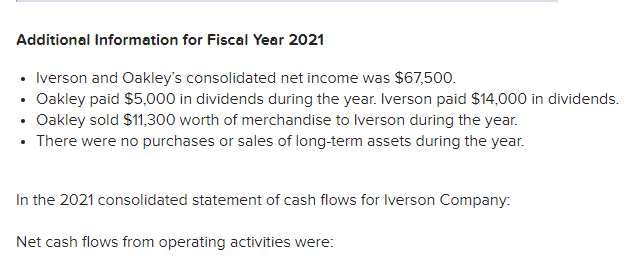

Problem 6-7 (Algo) (LO 6-5) Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent-owned subsidiary Oakley Co. follow: Additional Information for Fiscal Year 2021 - Iverson and Oakley's consolidated net income was $67,500. - Oakley paid $5,000 in dividends during the year. Iverson paid $14,000 in dividends. - Oakley sold $11,300 worth of merchandise to Iverson during the year. - There were no purchases or sales of long-term assets during the year. In the 2021 consolidated statement of cash flows for Iverson Company: Net cash flows from operating activities were: Multiple Choice $15,900. $31,800. $41,200. $26,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts