Question: Problem 8 (15 marks) Your grandson just turned 4 years old. You anticipate he will start University when he turns 18. You would like to

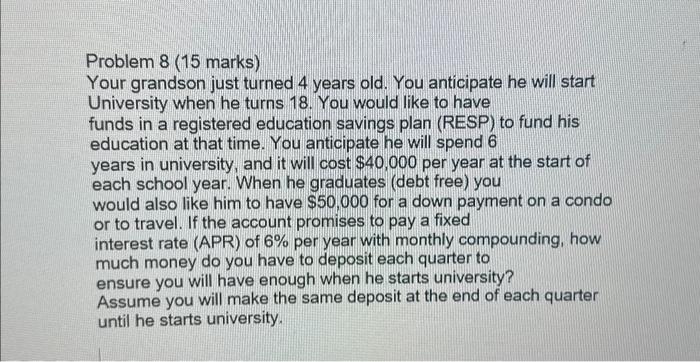

Problem 8 (15 marks) Your grandson just turned 4 years old. You anticipate he will start University when he turns 18. You would like to have funds in a registered education savings plan (RESP) to fund his education at that time. You anticipate he will spend 6 years in university, and it will cost $40,000 per year at the start of each school year. When he graduates (debt free) you would also like him to have $50,000 for a down payment on a condo or to travel. If the account promises to pay a fixed interest rate (APR) of 6% per year with monthly compounding, how much money do you have to deposit each quarter to ensure you will have enough when he starts university? Assume you will make the same deposit at the end of each quarter until he starts university

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts