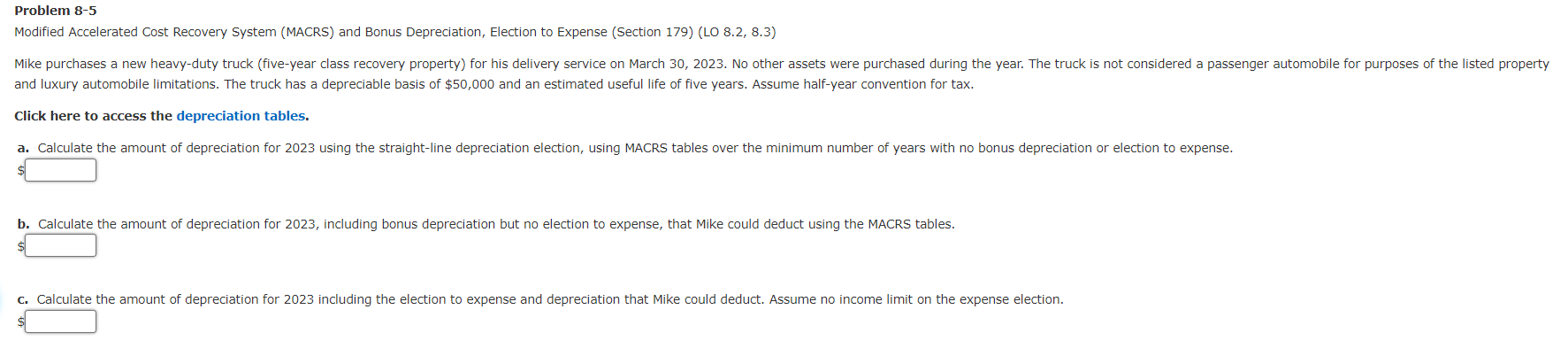

Question: Problem 8 - 5 Modified Accelerated Cost Recovery System ( MACRS ) and Bonus Depreciation, Election to Expense ( Section 1 7 9 ) (

Problem

Modified Accelerated Cost Recovery System MACRS and Bonus Depreciation, Election to Expense Section LO

and luxury automobile limitations The truck has a depreciable basis of $ and an estimated useful life of five years. Assume halfyear convention for tax.

Click here to access the depreciation tables.

a Calculate the amount of depreciation for using the straightline depreciation election, using MACRS tables over the minimum number of years with no bonus depreciation or election to expense.

b Calculate the amount of depreciation for including bonus depreciation but no election to expense, that Mike could deduct using the MACRS tables.

$

c Calculate the amount of depreciation for including the election to expense and depreciation that Mike could deduct. Assume no income limit on the expense election.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock