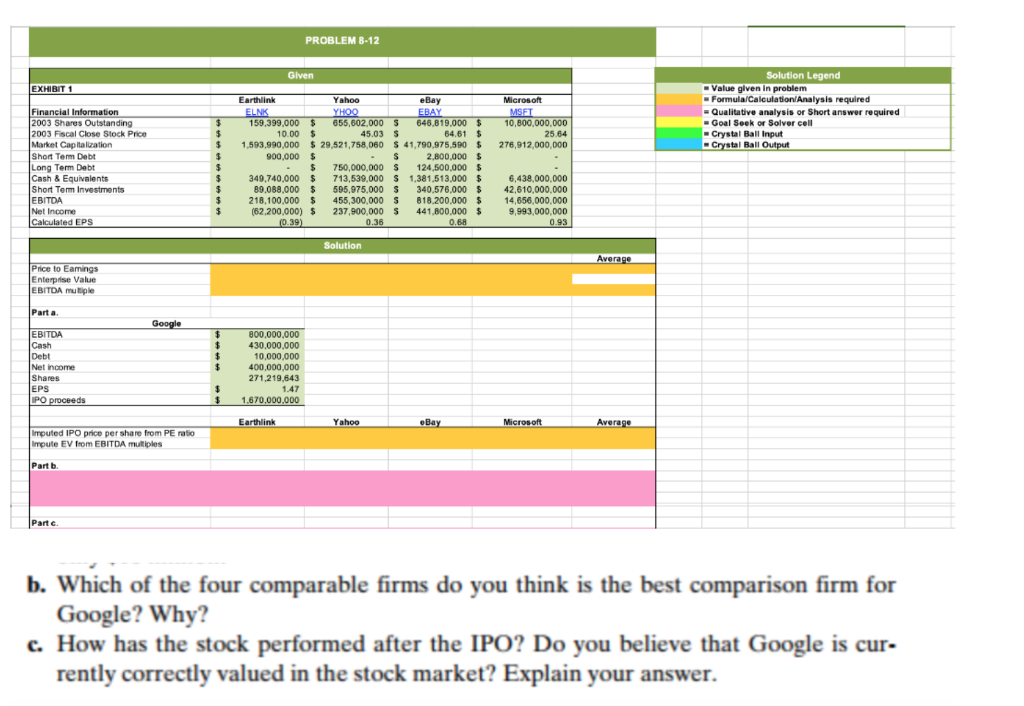

Question: PROBLEM 8-12 Given Solution Legend Value given in problem EXHIBIT 1 FormulalCalculation/Analysis required Earthlink Yahoo eBay Qualitative analysis or Short answer required Goal Seek or

PROBLEM 8-12 Given Solution Legend Value given in problem EXHIBIT 1 FormulalCalculation/Analysis required Earthlink Yahoo eBay Qualitative analysis or Short answer required Goal Seek or Solver cell 10,800,000,000 25.64 $ 1,593,990,000 $29,521,758,060 $ 41,790,975,590$ 276,912,000,00D 655,602,000 646,819,000 64.61 2003 Shares Outstanding 2003 Fscal Close Stock Price Market Capitalization Short Term Debt Long Term Debt 159,399,000 10.00 $ 45.03 S Crystal Ball Input Crystal Ball 900,000 2,800,000 750,000,000 S 124,500,000 . &Equivalents 349,740,000713,539,000 S 1,381,513,000 6,438,000.000 99,088.000 595,975,000 S340,576,00042,610,000,000 218,100.000455,300,000 S 818,200,000 14,656,000,000 (62,200,000) 237,900,000 S 441,800,0009,993,000,000 Short Tem Investments EBITDA Net Income Calculated Pice to Enterprise Value EBITDA muliple Part a EBITDA Cash 800,000,000 430,000,000 10,000,000 400,000,000 271,219,643 1.47 Net income Shares EPS ds Yahoo arthlin Microsoft Avera Imputed IPO price per share from PE ratio mpute EV fom EBITDA mutiples Part b Part G b. Which of the four comparable firms do you think is the best comparison firm for Google? Why? c. How has the stock performed after the IPO? Do you believe that Google is cur- rently correctly valued in the stock market? Explain your answer PROBLEM 8-12 Given Solution Legend Value given in problem EXHIBIT 1 FormulalCalculation/Analysis required Earthlink Yahoo eBay Qualitative analysis or Short answer required Goal Seek or Solver cell 10,800,000,000 25.64 $ 1,593,990,000 $29,521,758,060 $ 41,790,975,590$ 276,912,000,00D 655,602,000 646,819,000 64.61 2003 Shares Outstanding 2003 Fscal Close Stock Price Market Capitalization Short Term Debt Long Term Debt 159,399,000 10.00 $ 45.03 S Crystal Ball Input Crystal Ball 900,000 2,800,000 750,000,000 S 124,500,000 . &Equivalents 349,740,000713,539,000 S 1,381,513,000 6,438,000.000 99,088.000 595,975,000 S340,576,00042,610,000,000 218,100.000455,300,000 S 818,200,000 14,656,000,000 (62,200,000) 237,900,000 S 441,800,0009,993,000,000 Short Tem Investments EBITDA Net Income Calculated Pice to Enterprise Value EBITDA muliple Part a EBITDA Cash 800,000,000 430,000,000 10,000,000 400,000,000 271,219,643 1.47 Net income Shares EPS ds Yahoo arthlin Microsoft Avera Imputed IPO price per share from PE ratio mpute EV fom EBITDA mutiples Part b Part G b. Which of the four comparable firms do you think is the best comparison firm for Google? Why? c. How has the stock performed after the IPO? Do you believe that Google is cur- rently correctly valued in the stock market? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts