Question: Problem 8.17 Crane, Inc., has a bond issue maturing in seven years that is paying a coupon rate of 9.0 percent (semiannual payments). Management wants

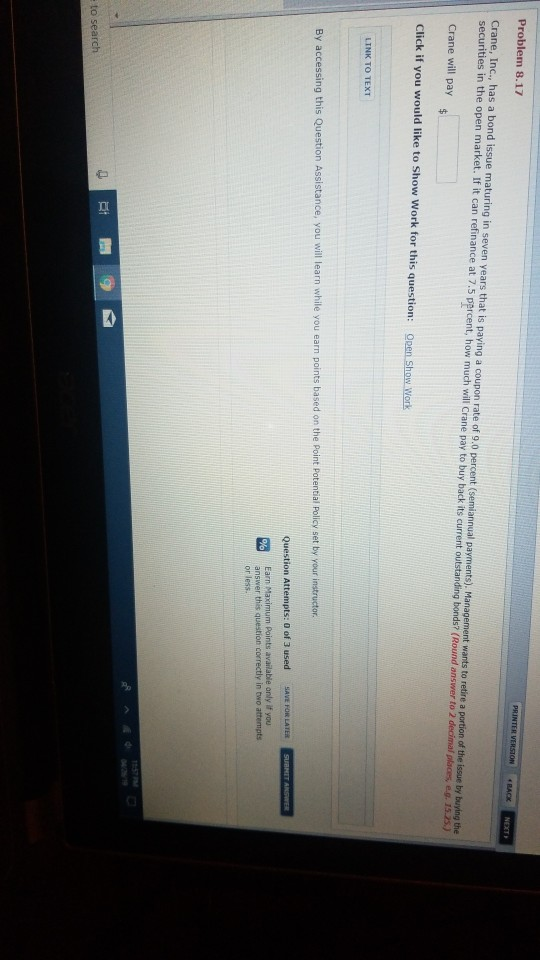

Problem 8.17 Crane, Inc., has a bond issue maturing in seven years that is paying a coupon rate of 9.0 percent (semiannual payments). Management wants to retire a portion of the issue by buying the securities in the open market. If it can refinance at 7.5 percent, how much will Crane pay to buy back its places, e.g. 1525) current outstanding bonds? (Round answer to 2 decimal Crane will pay Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. SAVE FOR LATER Question Attempts: 0 of 3 used or less to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts