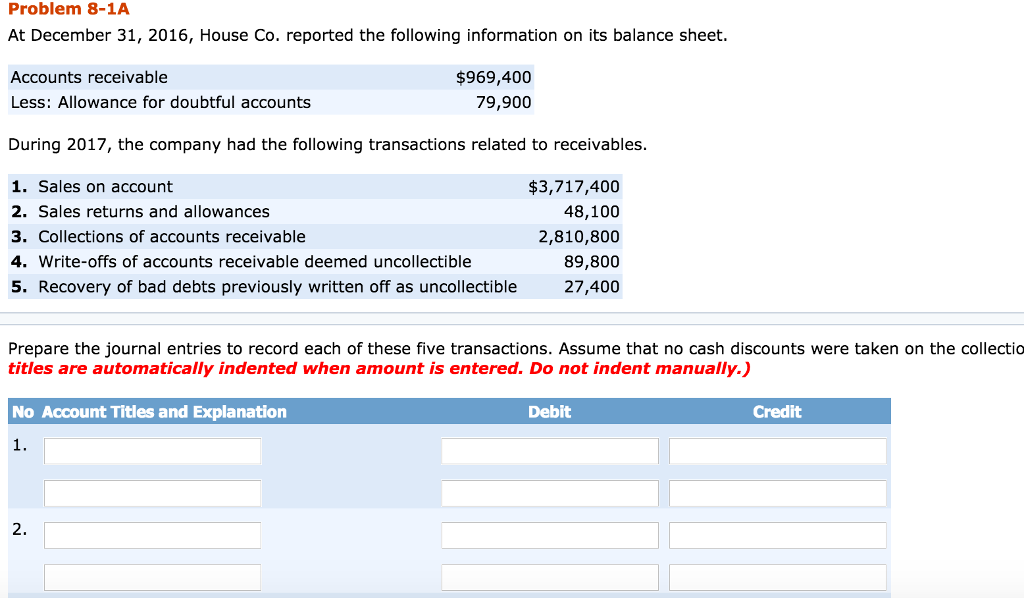

Question: Problem 8-1A At December 31, 2016, House Co. reported the following information on its balance sheet. Accounts receivable $969,400 79,900 Less: Allowance for doubtful accounts

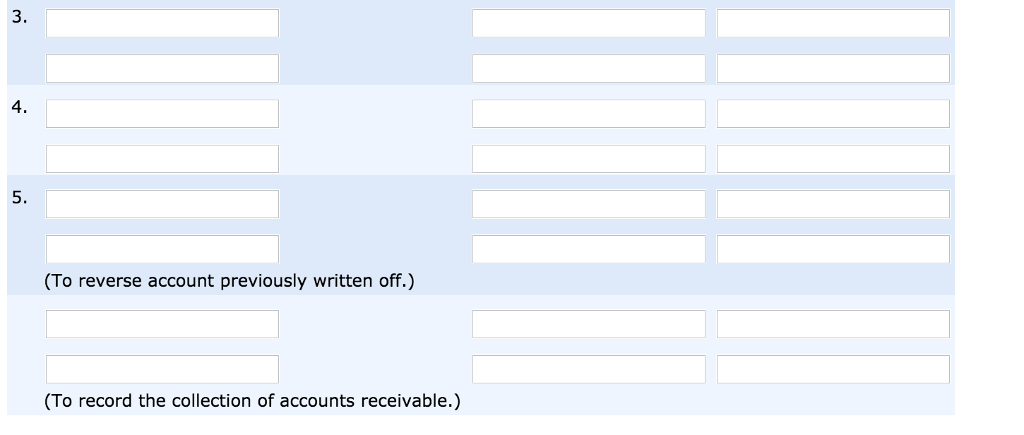

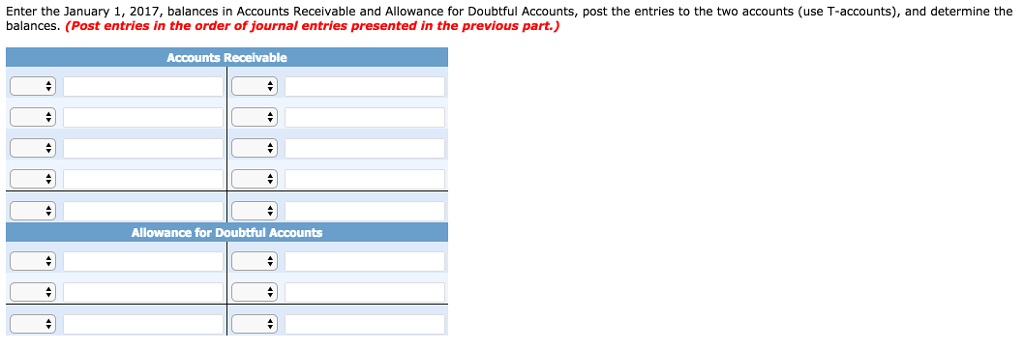

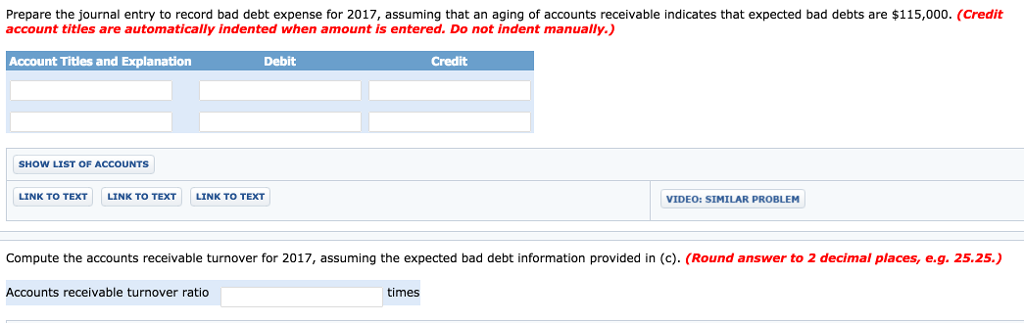

Problem 8-1A At December 31, 2016, House Co. reported the following information on its balance sheet. Accounts receivable $969,400 79,900 Less: Allowance for doubtful accounts During 2017, the company had the following transactions related to receivables. 1. Sales on account $3,717,400 48,100 2. Sales returns and allowances 2,810,800 3. Collections of accounts receivable 4. Write-offs of accounts receivable deemed uncollectible 89,800 5. Recovery of bad debts previously written off as uncollectible 27,400 Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on the collectio titles are automatically indented when amount is entered. Do not indent manually.) Debit No Account Titles and Explanation Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts