Question: Problem 8.4 Boeing just signed a contract to sell a Boeing 737 aircraft to Air France Air France will be billed 2014 million payable in

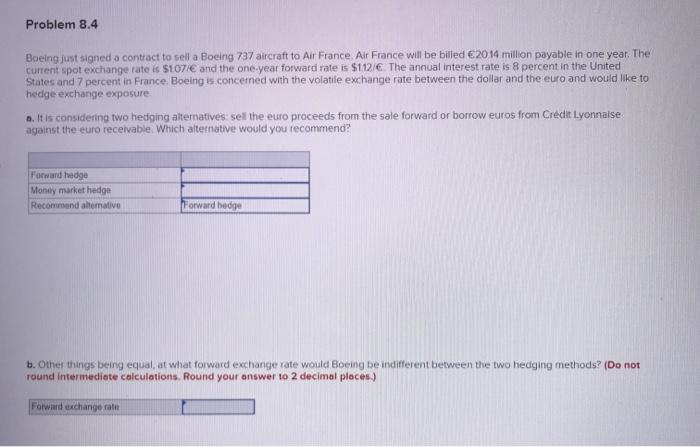

Problem 8.4 Boeing just signed a contract to sell a Boeing 737 aircraft to Air France Air France will be billed 2014 million payable in one year. The current spot exchange rate is $107/ and the one year forward rate is $112/ The annual interest rate is 8 percent in the United States and 7 percent in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure a. It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from Credit Lyonnaise against the euro receivable Which alternative would you recommend? Forward hedge Mondy market hedge Recommend alternative Forward hedge b. Other things being equal, at what forward exchange rate would Boeing be indifferent between the two hedging methods? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Forward exchange rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts