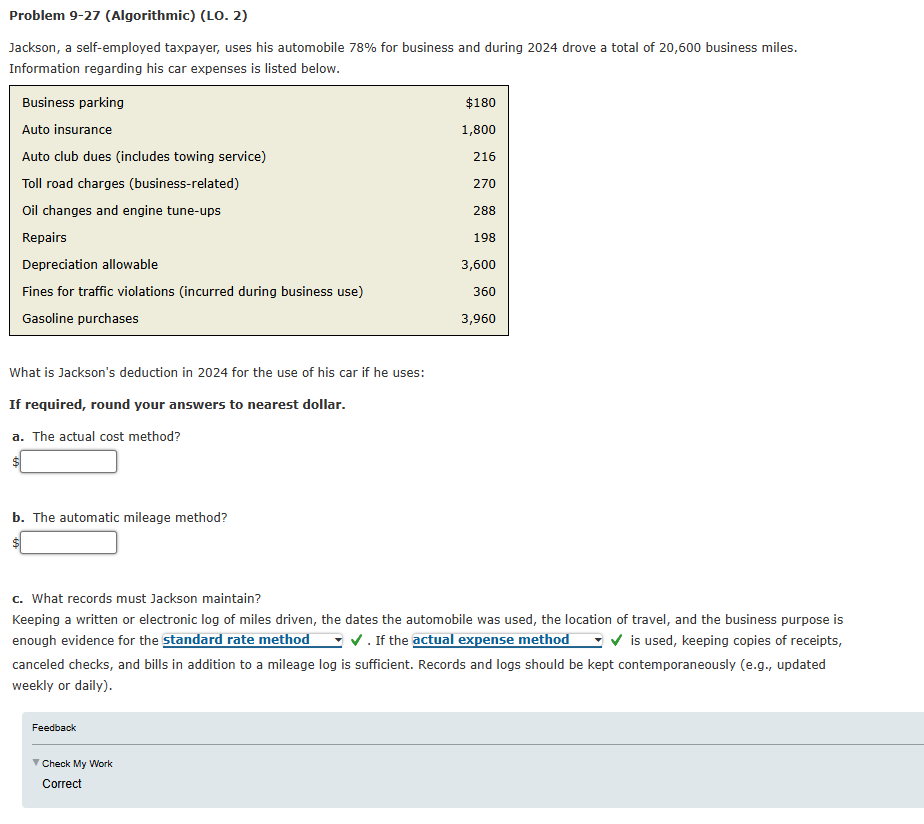

Question: Problem 9 - 2 7 ( Algorithmic ) ( LO . 2 ) Jackson, a self - employed taxpayer, uses his automobile 7 8

Problem AlgorithmicLO Jackson, a selfemployed taxpayer, uses his automobile for business and during drove a total of business miles. Information regarding his car expenses is listed below. What is Jackson's deduction in for the use of his car if he uses: If required, round your answers to nearest dollar. a The actual cost method? $ b The automatic mileage method? $ c What records must Jackson maintain? Keeping a written or electronic log of miles driven, the dates the automobile was used, the location of travel, and the business purpose is enough evidence for the standard rate method checkmark If the actual expense method checkmark checkmark is used, keeping copies of receipts, canceled checks, and bills in addition to a mileage log is sufficient. Records and logs should be kept contemporaneously eg updated weekly or daily Feedback

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock