Question: Problem 9. Greeks (7 pts) You are given the data in the table below regarding the price and sensitivity of 4 European options with maturity

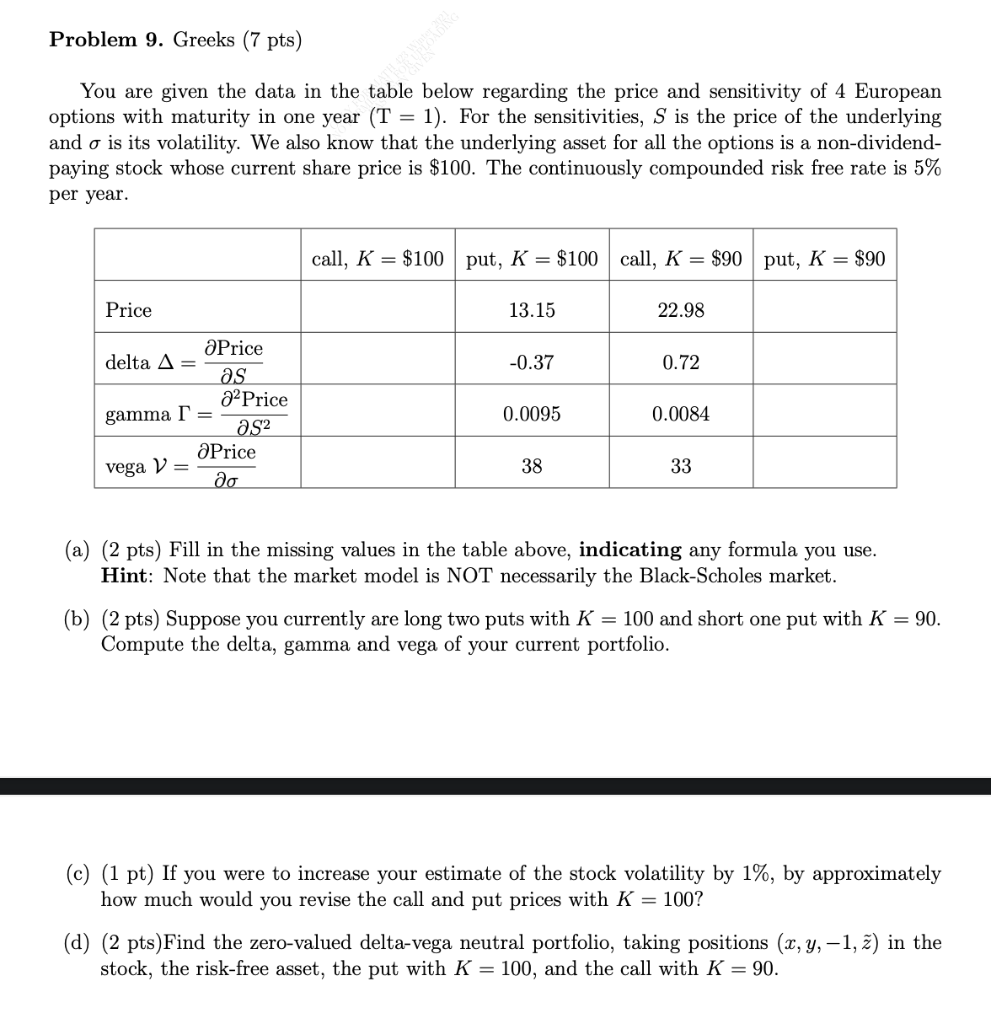

Problem 9. Greeks (7 pts) You are given the data in the table below regarding the price and sensitivity of 4 European options with maturity in one year (T = 1). For the sensitivities, S is the price of the underlying and o is its volatility. We also know that the underlying asset for all the options is a non-dividend- paying stock whose current share price is $100. The continuously compounded risk free rate is 5% per year. call, K = $100 put, K = $100 call, K = $90 put, K = $90 Price 13.15 22.98 -0.37 0.72 aPrice delta A as 22 Price gamma as2 a Price V= ao 0.0095 0.0084 vega 38 33 (a) (2 pts) Fill in the missing values in the table above, indicating any formula you use. Hint: Note that the market model is NOT necessarily the Black-Scholes market. (b) (2 pts) Suppose you currently are long two puts with K = 100 and short one put with K = 90. Compute the delta, gamma and vega of your current portfolio. (c) (1 pt) If you were to increase your estimate of the stock volatility by 1%, by approximately how much would you revise the call and put prices with K = 100? (d) (2 pts)Find the zero-valued delta-vega neutral portfolio, taking positions (x, y, -1, ) in the stock, the risk-free asset, the put with K = 100, and the call with K = 90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts