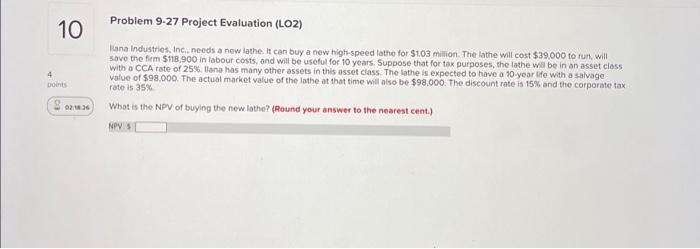

Question: Problem 9-27 Project Evaluation (LO2) liana Industries, Inc., needs a now lathe. It can buy a new high-speed lathe for $1.03 million. The lathe will

Problem 9-27 Project Evaluation (LO2) liana Industries, Inc., needs a now lathe. It can buy a new high-speed lathe for $1.03 million. The lathe will cost $39.000 to run, will save the firm $118,900 in labour costs, and will be useful for 10 years. Suppose that for tax purposes, the lathe wal be in an asset class with a CCA tate of 25%. Hana has many other assets in this asset class. The lathe is expected to have a 10-year life with a saivage vafue of $98,000. The actual market value of the lathe at that time will also be $98,000. The discount rate is 15% and the corporate tax rate is 35% What is the NPV of buying the new lathe? (Round your answer to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts