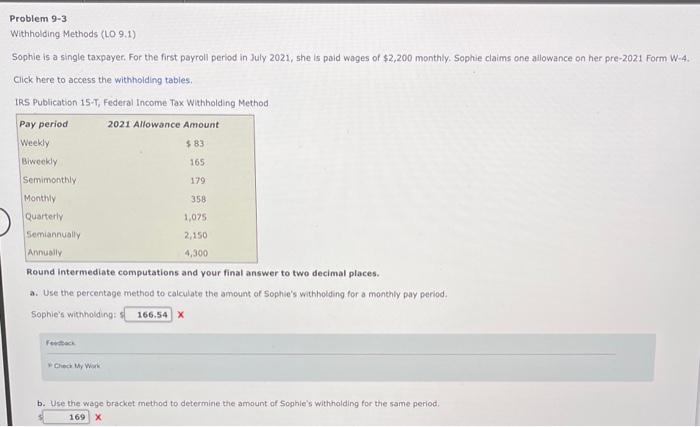

Question: Problem 9-3 Withholding Methods (LO 9.1) Sophie is a single taxpayer. For the first payroll period in July 2021, she is paid wages of $2,200

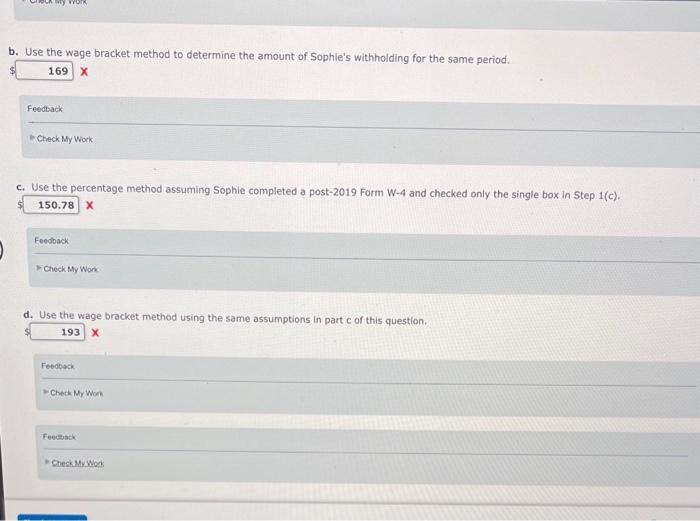

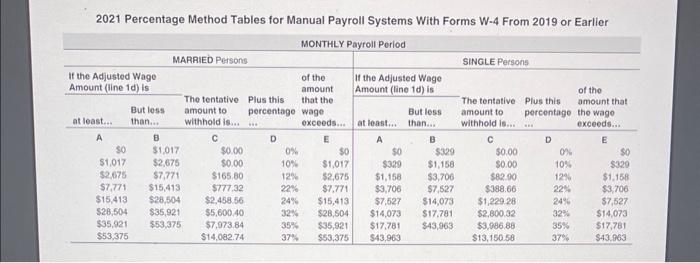

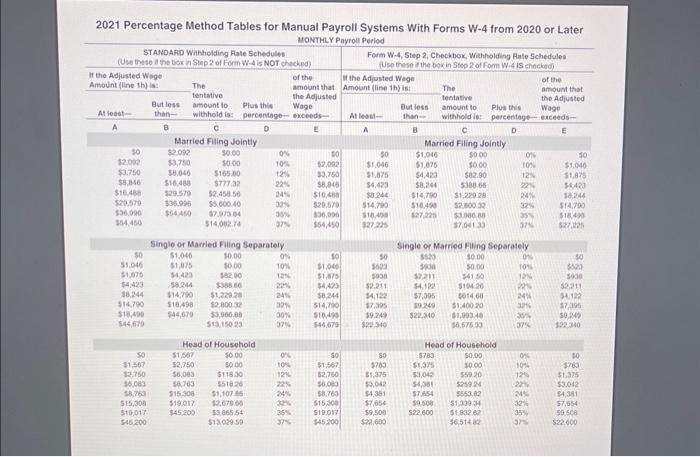

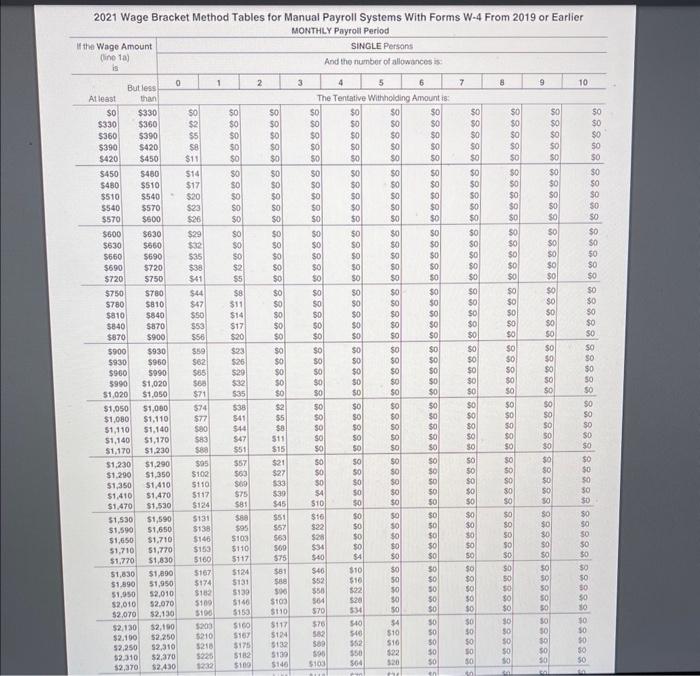

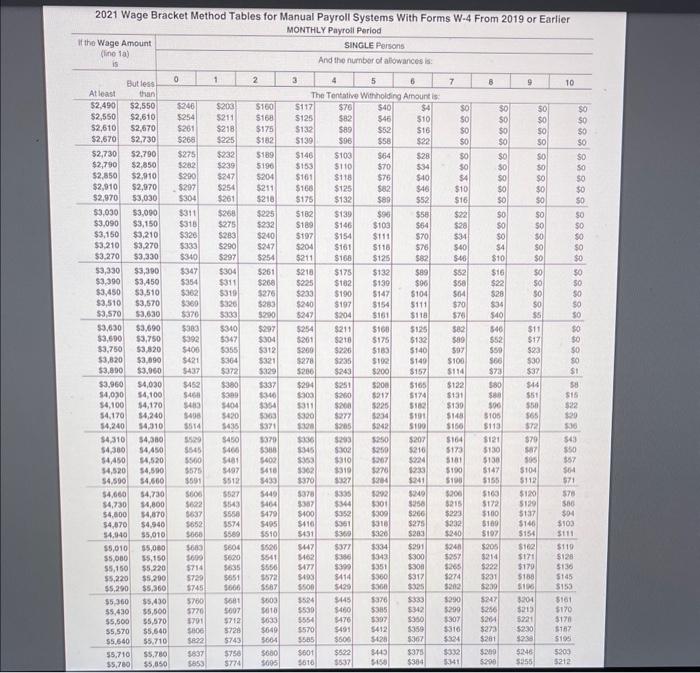

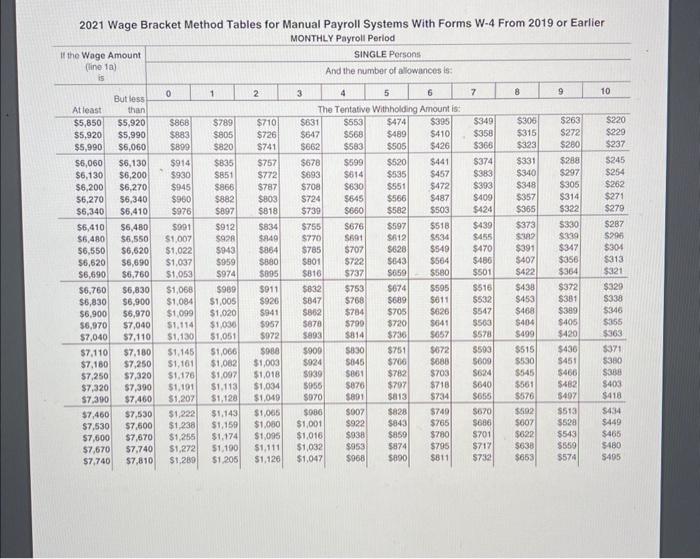

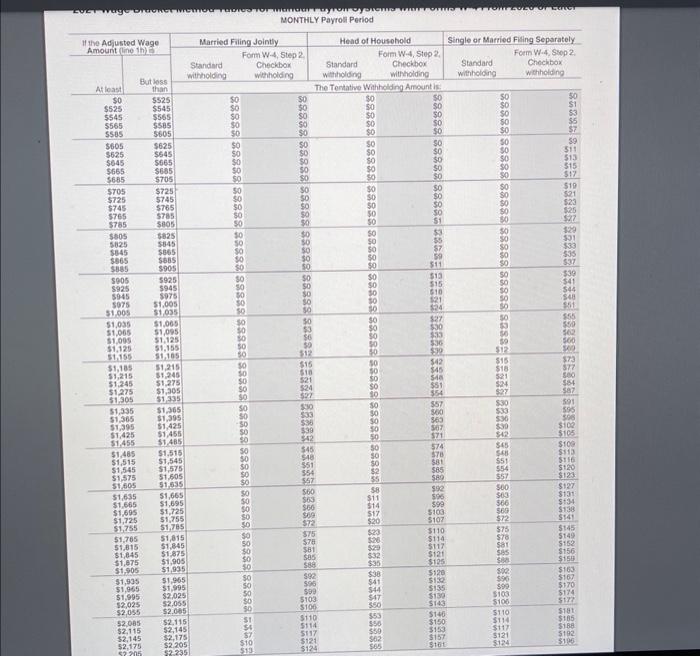

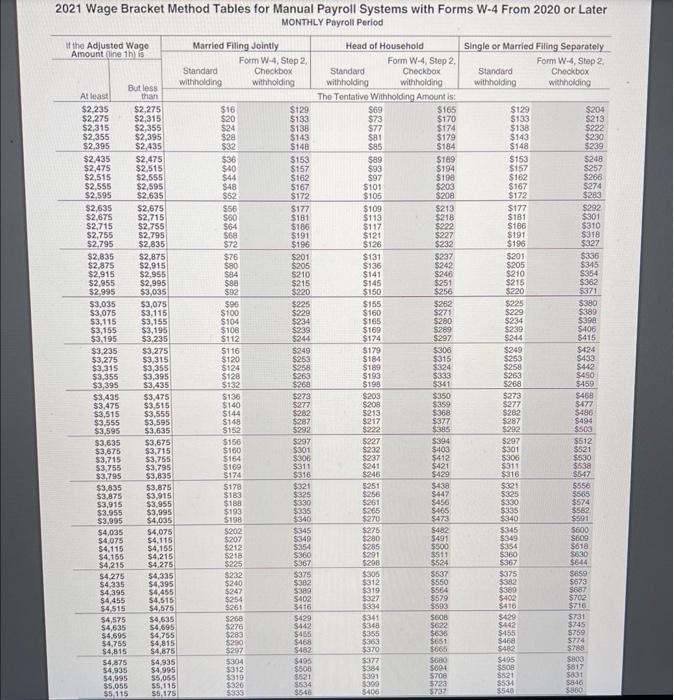

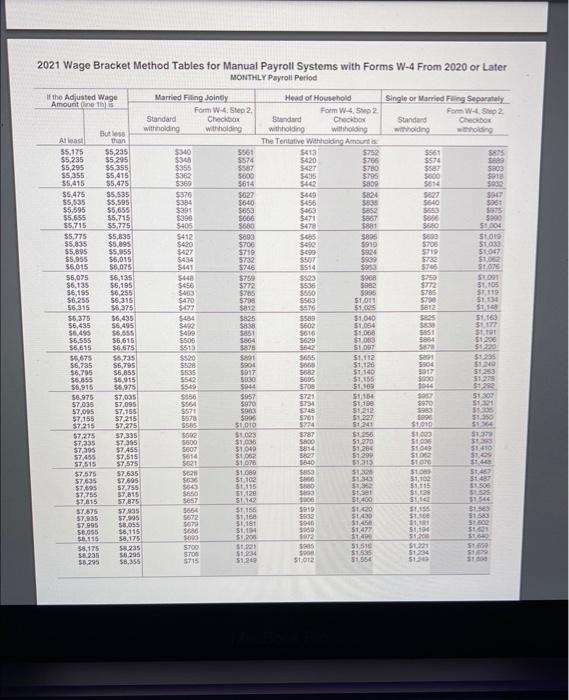

Problem 9-3 Withholding Methods (LO 9.1) Sophie is a single taxpayer. For the first payroll period in July 2021, she is paid wages of $2,200 monthly. Sophie claims one allowance on her pre-2021 Form W-4. Click here to access the withhoiding tables. IRS Publication 15-T, Federal Income Tax Withholding Method Round intermediate computations and your final answer to two decimal places. a. Use the percentage method to calculate the amount of Sophie's withholding for a monchly pay period. Sophie's withholding: 1 x Fevettack V check My wisk b. Use the wage bracket method to determine the amount of 5 ophie's withholding for the same period: x Use the wage bracket method to determine the amount of Sophie's withholding for the same period. x Feedback b Check My Wock c. Use the percentage method assuming Sophie completed a post-2019 Form W-4 and checked only the single box in Step 1 (c). x Feodback b Check My Work d. Use the wage bracket method using the same assumptions in part c of this question. x Fecobsich Phesk My Work 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier 2n21 Perrontane Mathad Tohloe tar 2021 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier MONTHLY Payroll Period 2021 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier MONTHLY Payroll Period It the Wage Amount SINCLE Persons (line 1a) And the number of aliowances is: 2021 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier MONTHLY Payroll Period MONTHLY Payroal Perlod 2021 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later MONTHLY Payroll Period 2021 Waen Brackat Mathed Tahlee fnr Manual Paurnil Suetome with Fnrme W.A Finm snon ar I atav

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts