Question: Problem: Module 9 Textbook Problem 1 Learning Objective: 9.1 Explain the advantage of start-up losses in a passthrough entity Mt. Tuck and Ms. Under organized

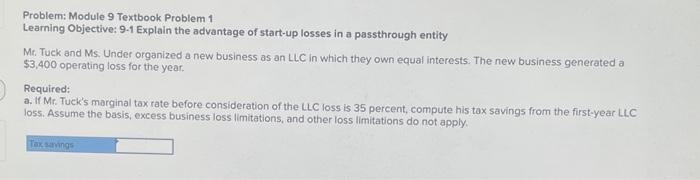

Problem: Module 9 Textbook Problem 1 Learning Objective: 9.1 Explain the advantage of start-up losses in a passthrough entity Mt. Tuck and Ms. Under organized a new business as an LLC in which they own equal interests. The new business generated a $3,400 operating loss for the year. Required: a. If Mr. Tuck's marginal tax rate before consideration of the LLC loss is 35 percent, compute his tax savings from the first-year LLC loss. Assume the basis, excess business loss limitations, and other loss limitations do not apply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts