Question: sexond and third picture are the same question Problem 2 Learning Objective: 9-1 Explain the advantage of start-up losses in a possthrough entity Grant and

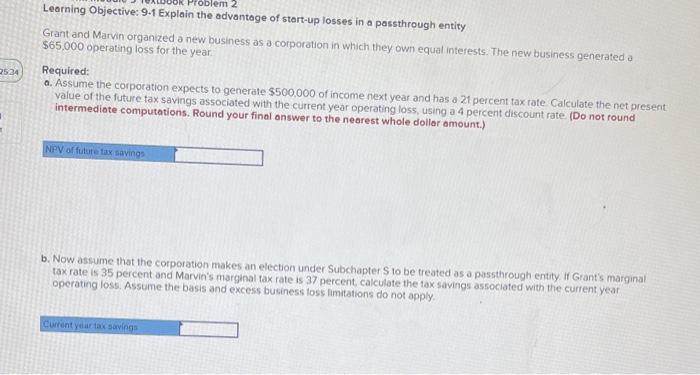

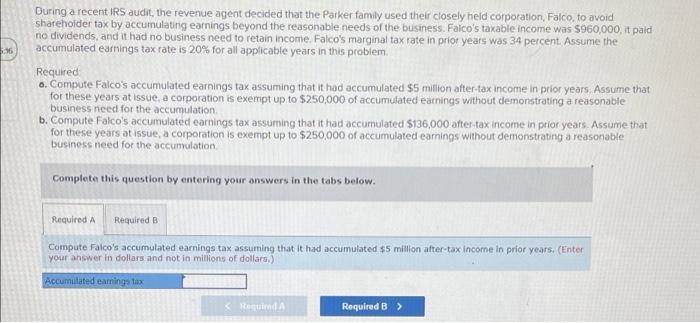

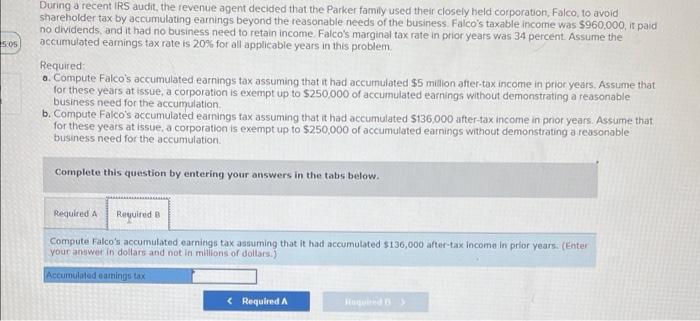

Problem 2 Learning Objective: 9-1 Explain the advantage of start-up losses in a possthrough entity Grant and Marvin organized a new business as a corporation in which they own equal interests. The new business generated a $65,000 operating loss for the year. Required: a. Assume the corporation expects to generate $500,000 of income next year and has a 21 percent tax rate Calculate the net present value of the future tax savings associated with the current year operating loss, using a 4 percent discount rate (Do not round intermediate computations, Round your final answer to the nearest whole dollar amount.) 2524 NPV of future tax savings b. Now assume that the corporation makes an election under Subchapter to be treated as a passthrough entity. If Grant's marginal tax rate is 35 percent and Marvin's marginal tax rate is 37 percent, calculate the tax savings associated with the current year operating loss. Assume the basis and excess business foss limitations do not apply Current year tax savings During a recent IRS audit, the revenue agent decided that the Parker family used their closely held corporation, Falco, to avoid shareholder tax by accumulating earnings beyond the reasonable needs of the business. Falco's taxable income was $960,000, it paid no dividends, and it had no business need to retain income. Falco's marginal tax rate in prior years was 34 percent Assume the accumulated earnings tax rate is 20% for all applicable years in this problem Required a. Compute Falco's accumulated earnings tax assuming that it had accumulated $5 million after-tax income in prior years. Assume that for these years at issue a corporation is exempt up to $250,000 of accumulated earnings without demonstrating a reasonable business need for the accumulation b. Compute Falco's accumulated earnings tax assuming that it had accumulated $136,000 after tax income in prior years. Assume that for these years at issue, a corporation is exempt up to $250,000 of accumulated earnings without demonstrating a reasonable business need for the accumulation Complete this question by entering your answers in the tabs below. Required A Required B Compute Falco's accumulated earnings tax assuming that it had accumulated $5 million after tax income in prior years. (Enter your answer in dollars and not in millions of dollars.) Accumulated earning tax Requid Required B > 505 During a recent IRS audit, the revenue agent decided that the Parker family used their closely held corporation, Falco, to avoid shareholder tax by accumulating earnings beyond the reasonable needs of the business. Falco's taxable income was $960,000, it paid no dividends, and it had no business need to retain income Falco's marginal tax rate in prior years was 34 percent. Assume the accumulated earnings tax rate is 20% for all applicable years in this problem Required o. Compute Falco's accumulated earnings tax assuming that it had accumulated $5 million after-tax income in prior years. Assume that for these years at issue, a corporation is exempt up to $250,000 of accumulated earnings without demonstrating a reasonable business need for the accumulation b. Compute Falco's accumulated earnings tax assuming that it had accumulated S136,000 after-tax income in prior years. Assume that for these years at issue, a corporation is exempt up to $250,000 of accumulated earnings without demonstrating a reasonable business need for the accumulation Complete this question by entering your answers in the tabs below. Required A Required B Compute Falco's accumulated earnings tax assuming that it had accumulated $136,000 after-tax income in prior years. (Enter your answer in dollars and not in millions of dollars.) Accumulated earnings tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts