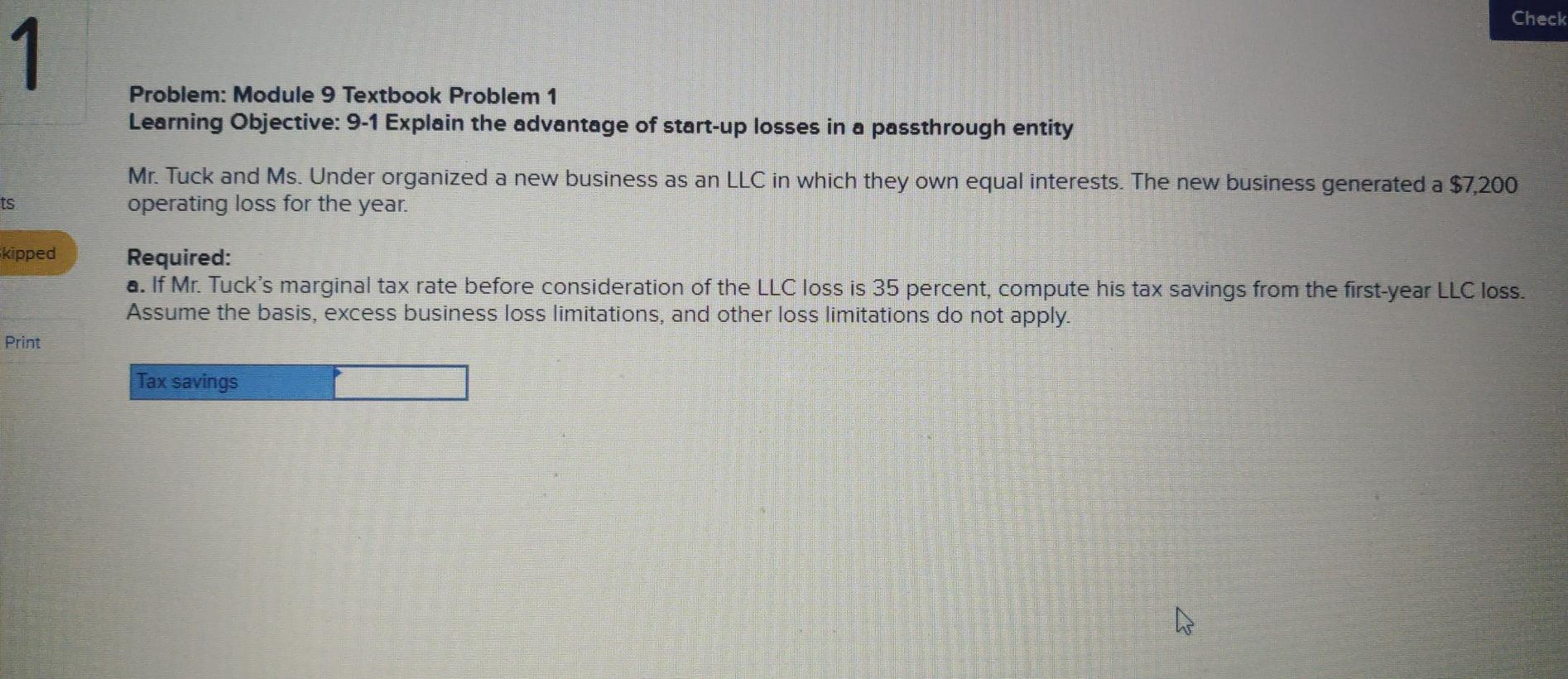

Question: Check 1 Problem: Module 9 Textbook Problem 1 Learning Objective: 9-1 Explain the advantage of start-up losses in a passthrough entity Mr. Tuck and Ms.

Check 1 Problem: Module 9 Textbook Problem 1 Learning Objective: 9-1 Explain the advantage of start-up losses in a passthrough entity Mr. Tuck and Ms. Under organized a new business as an LLC in which they own equal interests. The new business generated a $7,200 operating loss for the year. ts kipped Required: a. If Mr. Tuck's marginal tax rate before consideration of the LLC loss is 35 percent, compute his tax savings from the first-year LLC loss. Assume the basis, excess business loss limitations, and other loss limitations do not apply. Print Tax savings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts