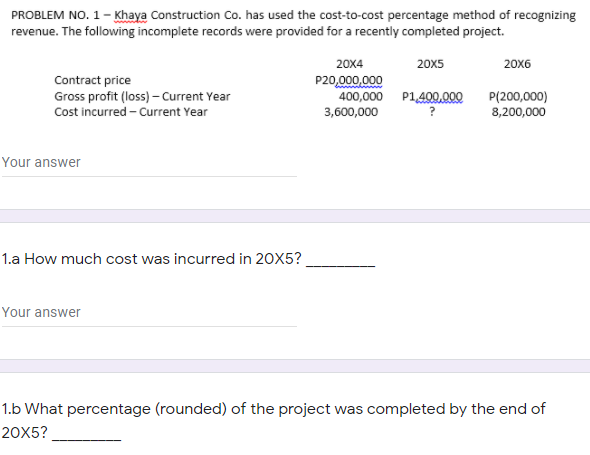

Question: PROBLEM NO. 1 - Khaya Construction Co. has used the cost-to-cost percentage method of recognizing revenue. The following incomplete records were provided for a recently

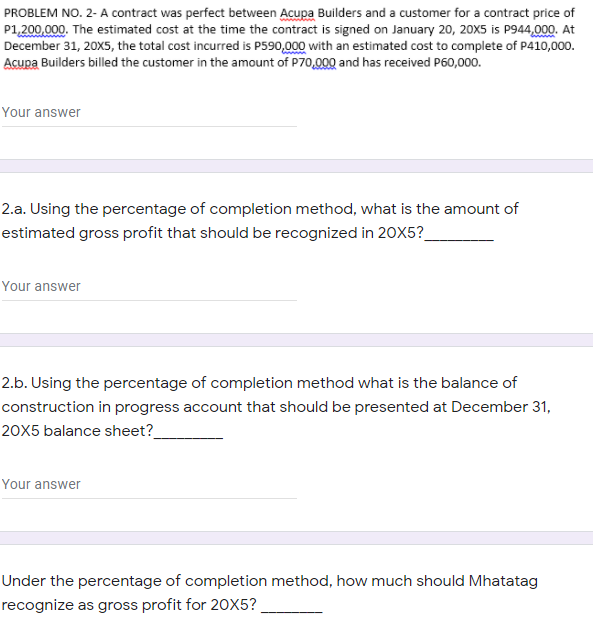

PROBLEM NO. 1 - Khaya Construction Co. has used the cost-to-cost percentage method of recognizing revenue. The following incomplete records were provided for a recently completed project. 20X4 20X5 20X6 Contract price P20,000,000 Gross profit (loss) - Current Year 400,000 P1 400,000 P(200,000) Cost incurred - Current Year 3,600,000 8,200,000 Your answer 1.a How much cost was incurred in 20X5? Your answer 1.b What percentage (rounded) of the project was completed by the end of 20X5?PROBLEM NO. 2- A contract was perfect between Acupa Builders and a customer for a contract price of P1,200,000. The estimated cost at the time the contract is signed on January 20, 20X5 is P944,000. At December 31, 20X5, the total cost incurred is P590,000 with an estimated cost to complete of P410,000. Acupa Builders billed the customer in the amount of P70,000 and has received P60,000. Your answer 2.a. Using the percentage of completion method, what is the amount of estimated gross profit that should be recognized in 20X5? Your answer 2.b. Using the percentage of completion method what is the balance of construction in progress account that should be presented at December 31, 20X5 balance sheet? Your answer Under the percentage of completion method, how much should Mhatatag recognize as gross profit for 20X5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts