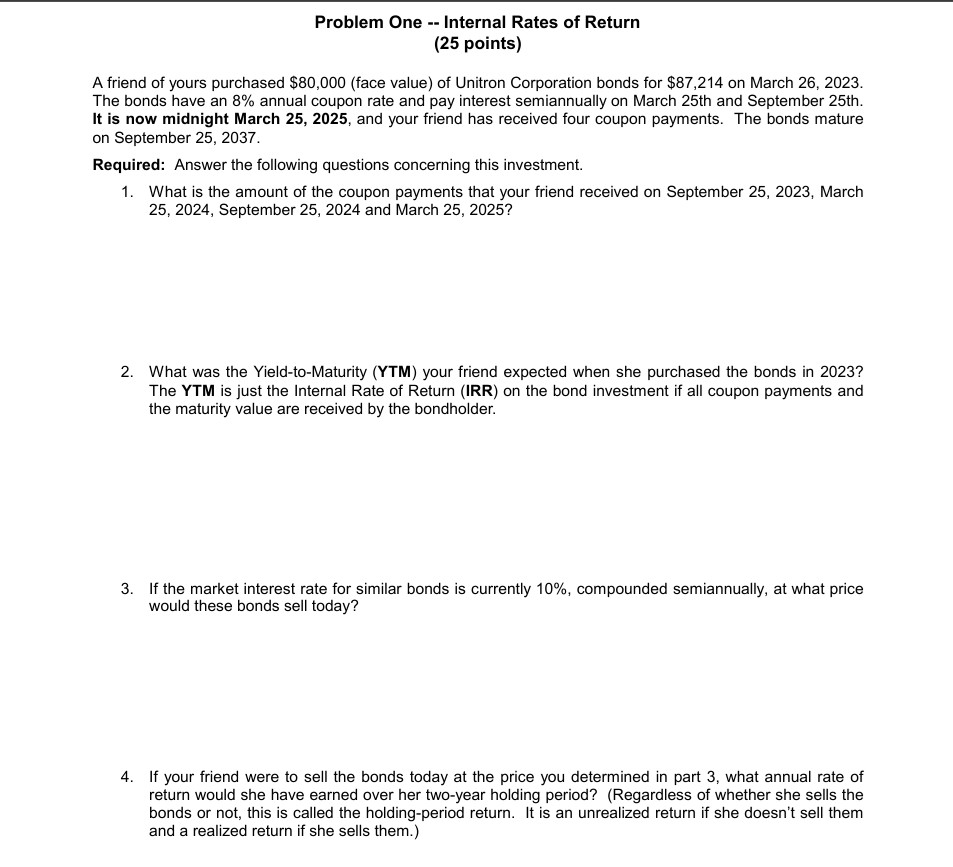

Question: Problem One - - Internal Rates of Return ( 2 5 points ) A friend of yours purchased ( $ 8 0 ,

Problem One Internal Rates of Return points A friend of yours purchased $ face value of Unitron Corporation bonds for $ on March The bonds have an annual coupon rate and pay interest semiannually on March th and September th It is now midnight March and your friend has received four coupon payments. The bonds mature on September Required: Answer the following questions concerning this investment. What is the amount of the coupon payments that your friend received on September March September and March What was the YieldtoMaturity YTM your friend expected when she purchased the bonds in The YTM is just the Internal Rate of Return IRR on the bond investment if all coupon payments and the maturity value are received by the bondholder. If the market interest rate for similar bonds is currently compounded semiannually, at what price would these bonds sell today? If your friend were to sell the bonds today at the price you determined in part what annual rate of return would she have earned over her twoyear holding period? Regardless of whether she sells the bonds or not, this is called the holdingperiod return. It is an unrealized return if she doesn't sell them and a realized return if she sells them.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock