Question: PROBLEM SE Basic 1. The Fisher equation tells us that the real interest rate approximately equals the nominal rate minus the inflation rate. Suppose the

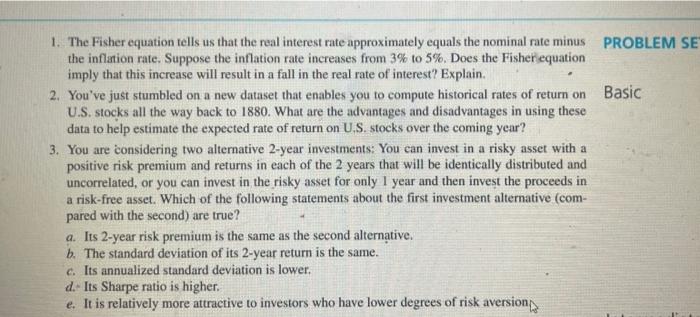

PROBLEM SE Basic 1. The Fisher equation tells us that the real interest rate approximately equals the nominal rate minus the inflation rate. Suppose the inflation rate increases from 3% to 5%. Does the Fisher equation imply that this increase will result in a fall in the real rate of interest? Explain. 2. You've just stumbled on a new dataset that enables you to compute historical rates of return on U.S. stocks all the way back to 1880. What are the advantages and disadvantages in using these data to help estimate the expected rate of return on U.S. stocks over the coming year? 3. You are considering two alternative 2-year investments: You can invest in a risky asset with a positive risk premium and returns in each of the 2 years that will be identically distributed and uncorrelated, or you can invest in the risky asset for only 1 year and then invest the proceeds in a risk-free asset. Which of the following statements about the first investment alternative (com- pared with the second) are true? a. Its 2-year risk premium is the same as the second alternative. b. The standard deviation of its 2-year return is the same. c. Its annualized standard deviation is lower. d. Its Sharpe ratio is higher. e. It is relatively more attractive to investors who have lower degrees of risk aversion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts