Question: Problem Set 5.1: Please answer questions 1 and 2 in a Word document. Please answer question 3 in Excel Submit your completed Word and Excel

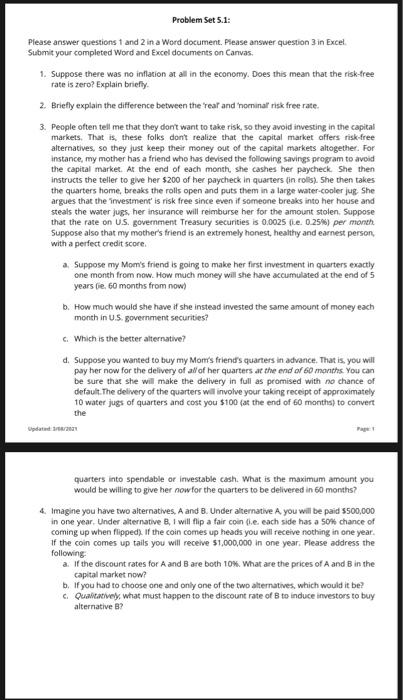

Problem Set 5.1: Please answer questions 1 and 2 in a Word document. Please answer question 3 in Excel Submit your completed Word and Excel documents on Canvas. 1. Suppose there was no inflation at all in the economy. Does this mean that the risk-free rate is zero? Explain briefly. 2. Briefly explain the difference between the real and nominal risk free rate. 3. People often tell me that they don't want to take risk, so they avoid investing in the capital markets. That is, these folks don't realize that the capital market offers risk-free alternatives, so they just keep their money out of the capital markets altogether. For instance, my mother has a friend who has devised the following savings program to avoid the capital market. At the end of each month, she cashes her paycheck. She then instructs the teller to give her $200 of her paycheck in quarters in rolls). She then takes the quarters home, breaks the rolls open and puts them in a large water-cooler jug She argues that the investment' is risk free since even if someone breaks into her house and steals the water jugs, her insurance will reimburse her for the amount stolen. Suppose that the rate on US government Treasury securities is 0.0025 ie 0.25%) per month Suppose also that my mother's friend is an extremely honest, healthy and earnest person, with a perfect credit score. a. Suppose my Mom's friend is going to make her first investment in quarters exactly one month from now. How much money will she have accumulated at the end of 5 years (ie, 60 months from now) b. How much would she have if she instead invested the same amount of money each month in US government securities? G. Which is the better alternative? d. Suppose you wanted to buy my Mom's friend's quarters in advance. That is you will pay her now for the delivery of all of her quarters at the end of 60 months You can be sure that she will make the delivery in full as promised with no chance of default. The delivery of the quarters will involve your taking receipt of approximately 10 water jugs of quarters and cost you $100 (at the end of 60 months) to convert the quarters into spendable or investable cash. What is the maximum amount you would be willing to give her now for the quarters to be delivered in 60 months? 4. Imagine you have two alternatives, A and B. Under alternative A you will be paid $500,000 in one year. Under alternative, I will flip a fair con le each side has a 50% chance of coming up when flipped) of the coin comes up heads you will receive nothing in one year If the coin comes up tails you will receive $1,000,000 in one year. Please address the following a. If the discount rates for A and B are both 10%. What are the prices of A and B in the capital market now? b. If you had to choose one and only one of the two alternatives, which would it be? c Qualitative, what must happen to the discount rate of B to induce investors to buy alternative B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts