Question: Problem Solving: Read carefully and analyze the given problem. 1. Clark is a classroom teacher in one of the private schools in his hometown with

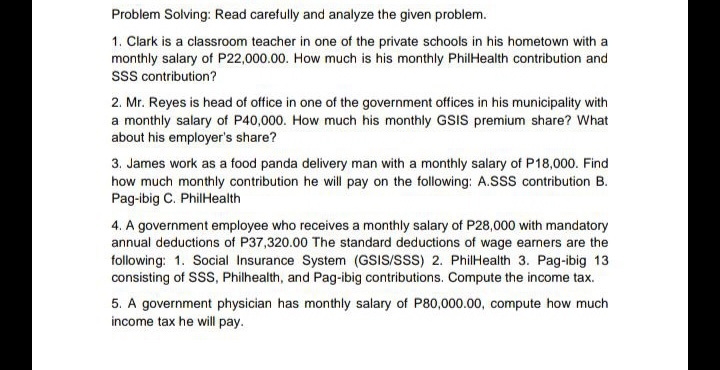

Problem Solving: Read carefully and analyze the given problem. 1. Clark is a classroom teacher in one of the private schools in his hometown with a monthly salary of P22,000.00. How much is his monthly PhilHealth contribution and SSS contribution? 2. Mr. Reyes is head of office in one of the government offices in his municipality with a monthly salary of P40,000. How much his monthly GSIS premium share? What about his employer's share? 3. James work as a food panda delivery man with a monthly salary of P18,000. Find how much monthly contribution he will pay on the following: A.SSS contribution B. Pag-ibig C. PhilHealth 4. A government employee who receives a monthly salary of P28,000 with mandatory annual deductions of P37,320.00 The standard deductions of wage earners are the following: 1. Social Insurance System (GSIS/SSS) 2. PhilHealth 3. Pag-ibig 13 consisting of SSS, Philhealth, and Pag-ibig contributions. Compute the income tax. 5. A government physician has monthly salary of P80,000.00, compute how much income tax he will pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts